Tube Rank: Your Guide to Video Success

Discover tips and insights for optimizing your video presence.

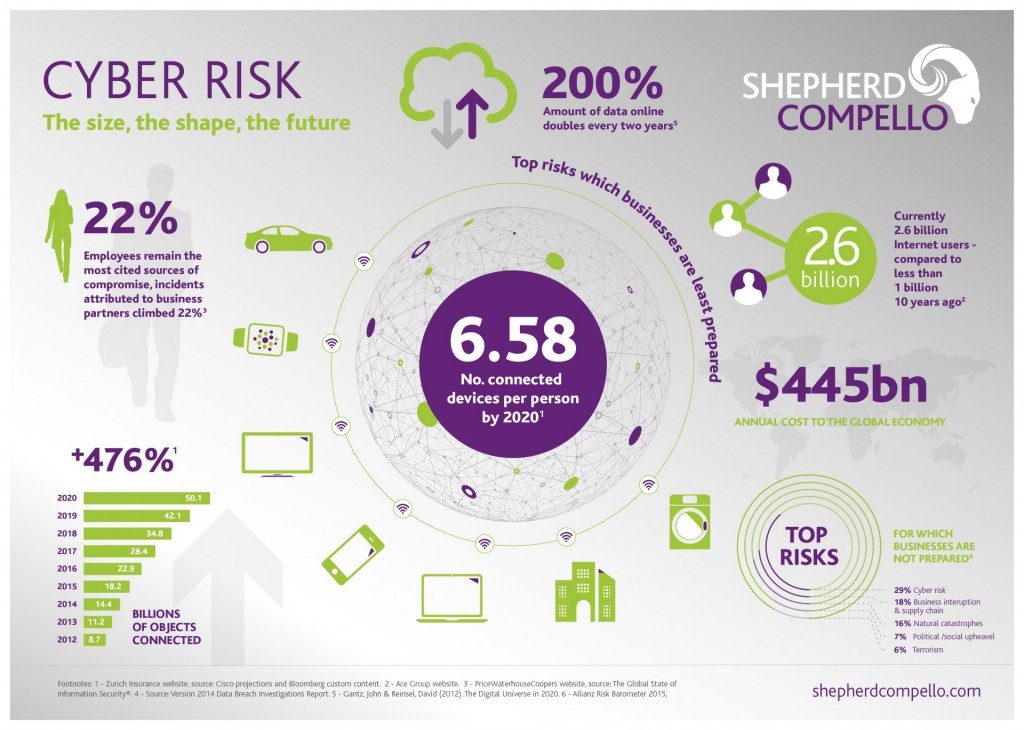

Cyber Liability Insurance: Are You Prepared for a Digital Disaster?

Discover if your business is ready for a digital disaster with essential insights on Cyber Liability Insurance. Don't wait—protect your future now!

Understanding Cyber Liability Insurance: Key Coverage Options for Your Business

Understanding Cyber Liability Insurance is essential for businesses in today's digital landscape. As cyber threats become more sophisticated, having the right coverage can protect your company from significant financial losses. This type of insurance typically includes several key coverage options, such as data breach liability, which covers the costs associated with notifying affected individuals, legal fees, and regulatory fines. Additionally, network security liability protects your business in the event of a security breach that affects third parties, ensuring that you are not solely liable for damages incurred.

Moreover, businesses should consider business interruption coverage, which compensates for lost income if a cyber incident disrupts operations. Another important aspect is media liability coverage, which protects against claims of copyright infringement or defamation related to your online content. In summary, understanding the various options under cyber liability insurance not only shields your business against potential threats but also enhances your overall risk management strategy.

Is Your Business at Risk? Essential Steps to Prepare for Cyber Threats

In today's digital landscape, cyber threats have become a pressing concern for businesses of all sizes. With increasing reliance on technology, it is crucial to assess whether your organization is at risk. Start by conducting a comprehensive risk assessment to identify potential vulnerabilities within your systems. Implementing strong password policies and keeping software updated are foundational steps to bolster your defenses. Additionally, consider investing in employee training programs to raise awareness about phishing attempts and social engineering tactics, as human error often leads to security breaches.

Once you've evaluated your risk levels, it’s essential to create a robust cybersecurity plan tailored to your business needs. This plan should include an incident response strategy that outlines clear steps to take in the event of a breach, ensuring minimal disruption to operations. Regularly backing up critical data and utilizing encryption methods can also enhance your protection against cyber threats. By taking these essential steps, you not only safeguard your company’s sensitive information but also build trust with your customers, reinforcing the message that you prioritize their security.

Cyber Liability Insurance Myths Debunked: What Every Business Owner Should Know

Cyber liability insurance can often be shrouded in myths that lead business owners to underestimate its importance. One common misconception is that only large corporations need this type of insurance. In reality, cyber attacks can target businesses of any size, and the financial repercussions can be devastating. According to industry experts, nearly 43% of cyber attacks target small businesses, making it crucial for all business owners to consider obtaining a policy tailored to their specific risks.

Another myth is that having strong cybersecurity measures means a business doesn't need cyber liability insurance. While robust security protocols are essential in protecting sensitive data, they cannot eliminate the risk of breaches entirely. Cyber liability insurance not only helps cover the costs associated with data breaches but also provides support during the recovery process, including legal fees and notification costs. Therefore, understanding and debunking these myths is vital for every business owner to safeguard their operations effectively.