Tube Rank: Your Guide to Video Success

Discover tips and insights for optimizing your video presence.

Discount Delight: Secrets to Slashing Your Auto Insurance Bill

Unlock hidden savings! Discover insider tips to slash your auto insurance bill and keep cash in your pocket. Your wallet will thank you!

5 Proven Strategies to Reduce Your Auto Insurance Premiums

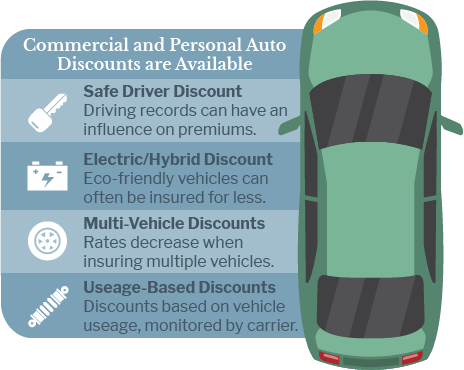

Reducing your auto insurance premiums can be achieved through a variety of proven strategies. First, consider shopping around for different providers. Obtaining quotes from multiple insurance companies allows you to find the best rates and coverage options tailored to your needs. Bundling your auto insurance with other types of insurance, such as home or renters insurance, can also lead to significant discounts. Additionally, taking advantage of available discounts, such as those for safe driving records or completing a defensive driving course, can further lower your premiums.

Another effective strategy is to review your coverage regularly. Depending on your vehicle's age and current market value, you might find that reducing your coverage on an older car can save you money. Increasing your deductible is another way to lower your premiums; just make sure you can afford the deductible in case of a claim. Lastly, maintaining a good credit score can have a positive impact on your auto insurance rates, as many insurers consider credit history in their pricing models.

Understanding Your Policy: How Coverage Choices Affect Costs

When selecting an insurance policy, it is essential to understand how your coverage choices directly affect your overall costs. Each policy usually offers various coverage options that cater to different needs, such as liability, collision, and comprehensive coverage. The more extensive your coverage, the higher your premiums will likely be. For instance, opting for full coverage on a new vehicle can provide peace of mind, but it also considerably increases your out-of-pocket expenses. Therefore, it’s crucial to assess your needs and budget before making a decision.

Moreover, different factors play a significant role in determining your policy's cost beyond just the type of coverage. These include your location, driving history, and the type of vehicle you own. For example, if you live in an area with high accident rates, your premium could be higher due to the increased risk. Additionally, maintaining a clean driving record can often lead to discounts, emphasizing the importance of understanding how your coverage choices and personal factors intertwine to impact your insurance costs. By being well-informed, you can make strategic decisions that protect your financial wellbeing.

Is Bundling Your Policies Really Worth It?

Bundling insurance policies has become a common practice for many consumers seeking to simplify their coverage and potentially save money. By combining multiple policies, such as home and auto insurance, policyholders may benefit from discounts offered by their insurance provider. These discounts can vary significantly and might lead to substantial savings over time. However, before making the decision to bundle, it’s essential to evaluate the overall cost and coverage options to ensure you are getting the best deal for your specific needs.

While the appeal of bundling your policies lies in convenience and potential savings, it’s crucial to consider the potential drawbacks as well. For instance, if one of the bundled policies does not meet your expectations or if the coverage is lacking, it may impact your overall satisfaction with all your insurance products. Additionally, it’s wise to compare bundled rates against individual policy rates from other providers to find the best overall value. Ultimately, the decision to bundle should be made after careful consideration of both the benefits and the possible downsides.