Tube Rank: Your Guide to Video Success

Discover tips and insights for optimizing your video presence.

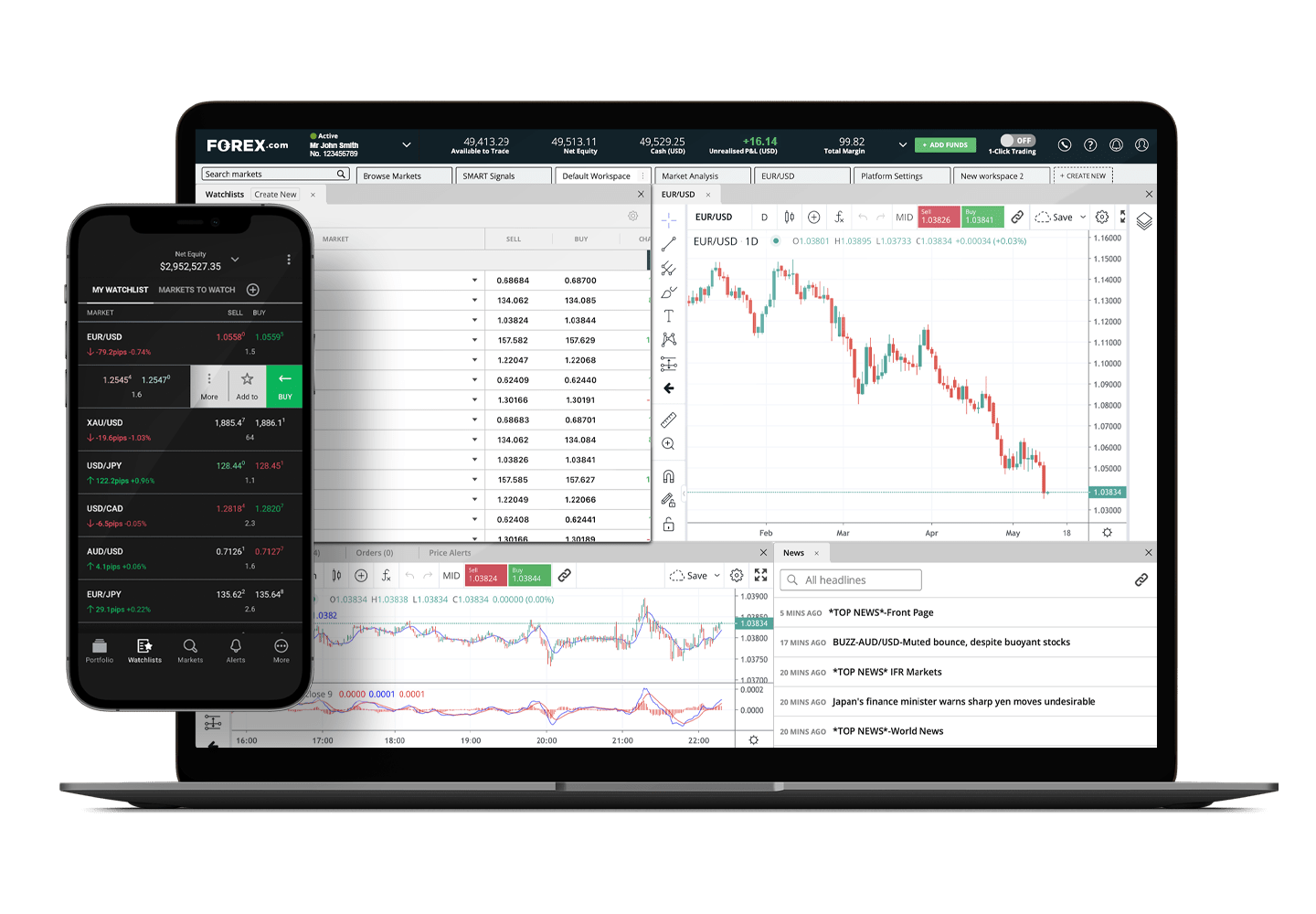

Forex Frenzy: How to Dance with Currency Markets Like a Pro

Unleash your trading potential! Master currency markets with insider tips and strategies in Forex Frenzy. Join the dance to profit today!

Understanding Currency Pairs: The Key to Forex Trading Success

In the realm of Forex trading, understanding currency pairs is crucial for success. A currency pair consists of two different currencies, with one being the base currency and the other the quote currency. For example, in the EUR/USD pair, the euro is the base currency, while the US dollar is the quote currency. The value of a currency pair indicates how much of the quote currency is needed to purchase one unit of the base currency. By grasping the dynamics of these pairs, traders can make informed decisions and capitalize on price fluctuations in the foreign exchange market.

There are several types of currency pairs that traders should familiarize themselves with:

- Major Currency Pairs: These involve the most traded currencies, such as USD, EUR, JPY, and GBP.

- Minor Currency Pairs: These pairs do not include the US dollar but consist of other major currencies, like EUR/GBP or AUD/NZD.

- Exotic Currency Pairs: These involve a major currency paired with a currency from a developing economy, such as USD/TRY (Turkish Lira).

Top 5 Strategies for Navigating Volatile Forex Markets

Navigating volatile Forex markets requires a solid strategy to minimize risks and maximize returns. One effective approach is to implement a robust risk management plan. This involves setting stop-loss orders and position sizing tailored to your risk tolerance. By placing limits on potential losses, traders can protect their capital from sudden market swings. Additionally, utilizing tools like moving averages can help in identifying trends and market sentiments, providing a clearer picture of potential price movements.

Another key strategy is to stay informed about global economic indicators that can impact currency values. For instance, interest rate announcements, employment figures, and geopolitical events can create volatility in the Forex market. By keeping an eye on the economic calendar and conducting thorough fundamental analysis, traders can anticipate significant market movements and position themselves accordingly. Lastly, embracing a disciplined approach to trading, such as maintaining consistent trading hours and review sessions, can help in making well-informed decisions in unpredictable environments.

Is Forex Trading Right for You? A Beginner's Guide to Making Money

Forex trading, short for foreign exchange trading, has gained immense popularity in recent years as a method for individuals to make money online. However, before diving in, it's essential to evaluate whether it aligns with your financial goals and risk appetite. **Forex trading requires a significant commitment to understanding market dynamics**, currency pairs, and trading strategies. If you're a beginner, it's crucial to educate yourself about key concepts such as leverage, pips, and margin trading. Moreover, consider starting with a demo account to practice without risking real money, which can help you build confidence and develop your trading skills.

Another important factor to consider is your personality and approach to risk. Forex trading can be highly volatile, and while it offers the potential for significant profits, it can equally lead to losses. **Take time to assess your risk tolerance**; are you comfortable with rapid changes in your investment? Many successful traders employ strict risk management practices, including setting stop-loss orders and diversifying their trading strategies. Ultimately, the decision of whether **Forex trading is right for you** hinges on your willingness to learn, adapt, and stay disciplined in your trading approach.