Tube Rank: Your Guide to Video Success

Discover tips and insights for optimizing your video presence.

Get in the Fast Lane to Car Ownership

Unlock your dream car faster than ever! Discover expert tips and secrets to turbocharge your journey to car ownership.

5 Essential Steps to Quick Car Ownership

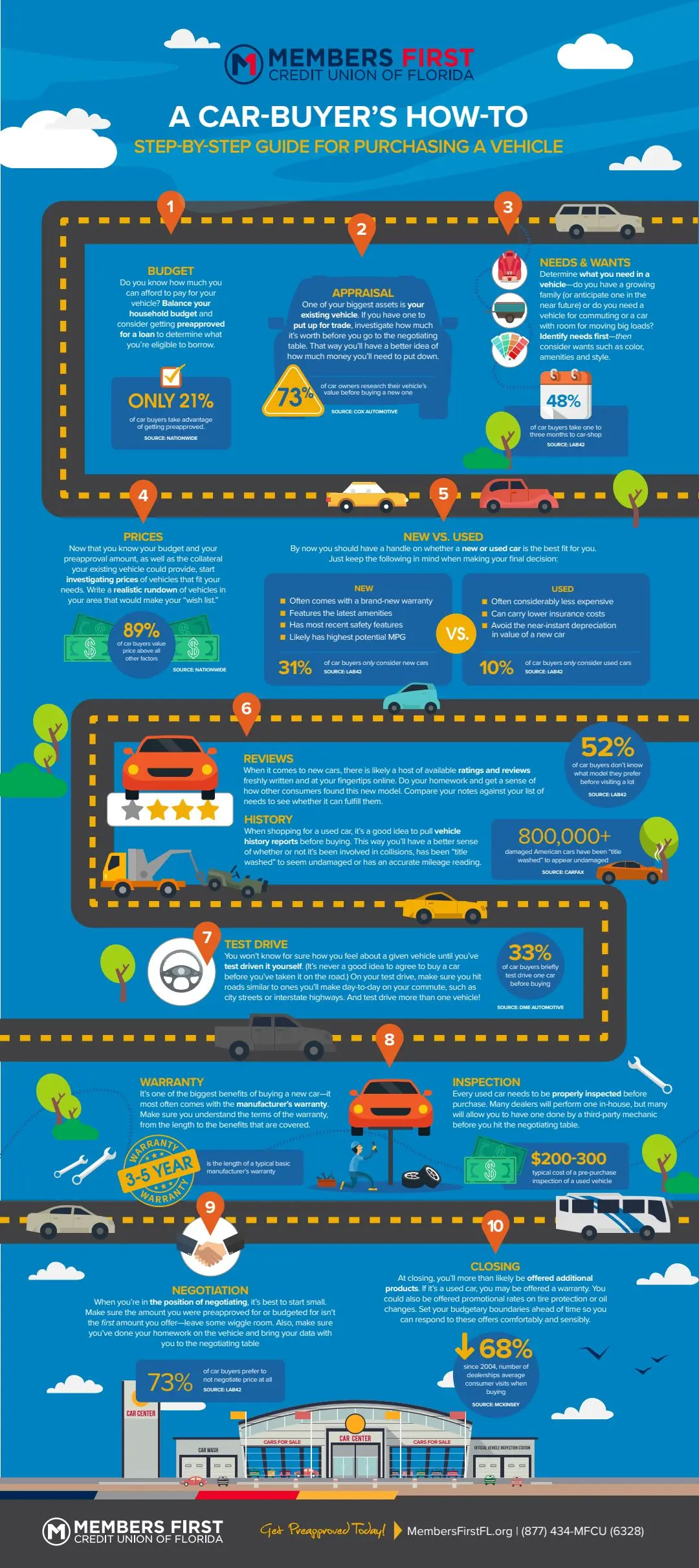

Embarking on the journey of car ownership can be both exciting and daunting. To streamline this process, follow these 5 essential steps to quick car ownership. First, assess your budget by calculating your income, expenses, and how much you can afford for a down payment and monthly payments. This initial financial evaluation will help set realistic expectations and narrow down your options.

Next, research the type of vehicle that fits your lifestyle. Consider daily usage, fuel efficiency, and maintenance costs. Once you have identified your preferred options, it’s time to explore financing and loan options. Comparing interest rates from lenders can save you a significant amount in the long run. Finally, conduct thorough inspections and test drives before making your final decision to ensure that your new vehicle meets all your needs and expectations.

Understanding Your Financing Options for a Fast Track to Car Ownership

Understanding your financing options is crucial for anyone looking to make a swift transition to car ownership. With various alternatives available, you can tailor your approach based on your financial situation. Popular options include bank loans, credit unions, and dealership financing. Each option has its own benefits; for instance, bank loans often offer competitive interest rates, while credit unions might provide more personalized service and flexible terms. Dealership financing can sometimes facilitate quicker transactions, especially during promotional periods.

Before making a decision, consider assessing your credit score and financial health, as these factors significantly influence your financing options. Personal loans can also be an alternative for those who prefer not to use traditional car loans, but they often come with higher interest rates. Prioritizing budgeting is essential to ensure that monthly payments align with your financial goals. By understanding these various financing avenues, you can confidently embark on your journey toward car ownership.

Is a Lease or Purchase Right for You? Exploring Your Car Ownership Choices

Deciding whether to lease or purchase a vehicle is an important choice that can significantly impact your finances and lifestyle. When you lease a car, you essentially rent it for a specific period, often enjoying lower monthly payments and the opportunity to drive a new model every few years. However, leasing often comes with mileage restrictions and the need to maintain the vehicle in good condition to avoid extra fees at the end of the lease term. On the other hand, purchasing a car can be seen as a long-term investment, providing ownership equity and the freedom to customize the vehicle without restrictions. Understanding your driving habits and financial situation will help you determine which option is more suited to your needs.

To make an informed decision, consider the following factors: financial flexibility, driving habits, and your long-term goals. If you enjoy driving a new car every few years and prefer to have lower payments, leasing may be appealing. Conversely, if you plan to keep a vehicle for many years and accumulate value, purchasing could be the better route. Both options have their pros and cons, so it’s essential to evaluate what you truly value in vehicle ownership before making a commitment. Ultimately, whether you choose to lease or purchase, understanding your individual circumstances will lead to a choice that aligns with your lifestyle.