Tube Rank: Your Guide to Video Success

Discover tips and insights for optimizing your video presence.

Insurance Showdown: The Battle of the Policies

Discover the ultimate showdown of insurance policies! Uncover the pros and cons to find the best coverage for your needs. Don't miss out!

Understanding Policy Types: Which Insurance is Right for You?

When it comes to choosing the right insurance, it's essential to understand policy types to make an informed decision. Insurance policies can typically be categorized into various types, including life, health, auto, and homeowners insurance. Each type serves a specific purpose and offers different levels of coverage, so assessing your personal needs is crucial. For example, if you have dependents, a comprehensive life insurance policy could provide them with financial security in the event of your untimely death. On the other hand, if you're a car owner, understanding the distinctions between liability, collision, and comprehensive auto insurance will help you select the right coverage for your situation.

It's also important to consider the various policy options available within each category. For instance, health insurance may come in the form of HMOs, PPOs, or HDHPs, each with its own set of rules and benefits. Meanwhile, homeowners insurance can be tailored to cover specific risks, such as natural disasters or personal property theft. As you evaluate these options, take the time to compare premiums, deductibles, and coverage limits to find a policy that aligns with your financial goals and lifestyle. By doing your homework and understanding policy types, you can confidently select the insurance that best suits your needs.

The Ultimate Guide to Comparing Life, Health, and Auto Insurance

When it comes to securing financial peace of mind, understanding the nuances of life insurance, health insurance, and auto insurance is essential. Each type of insurance serves a unique purpose and comes with its own set of features and benefits. For instance, life insurance provides financial protection to your family in the event of your untimely demise, ensuring they are not burdened by debts or loss of income. On the other hand, health insurance covers medical expenses, allowing you access to necessary healthcare without overwhelming costs. Lastly, auto insurance protects you and your vehicle from unforeseen accidents or damages, providing crucial support in case of emergencies.

When comparing life, health, and auto insurance, it's important to consider several factors:

- Coverage Options: Analyze what type of coverage is available under each policy and how it aligns with your specific needs.

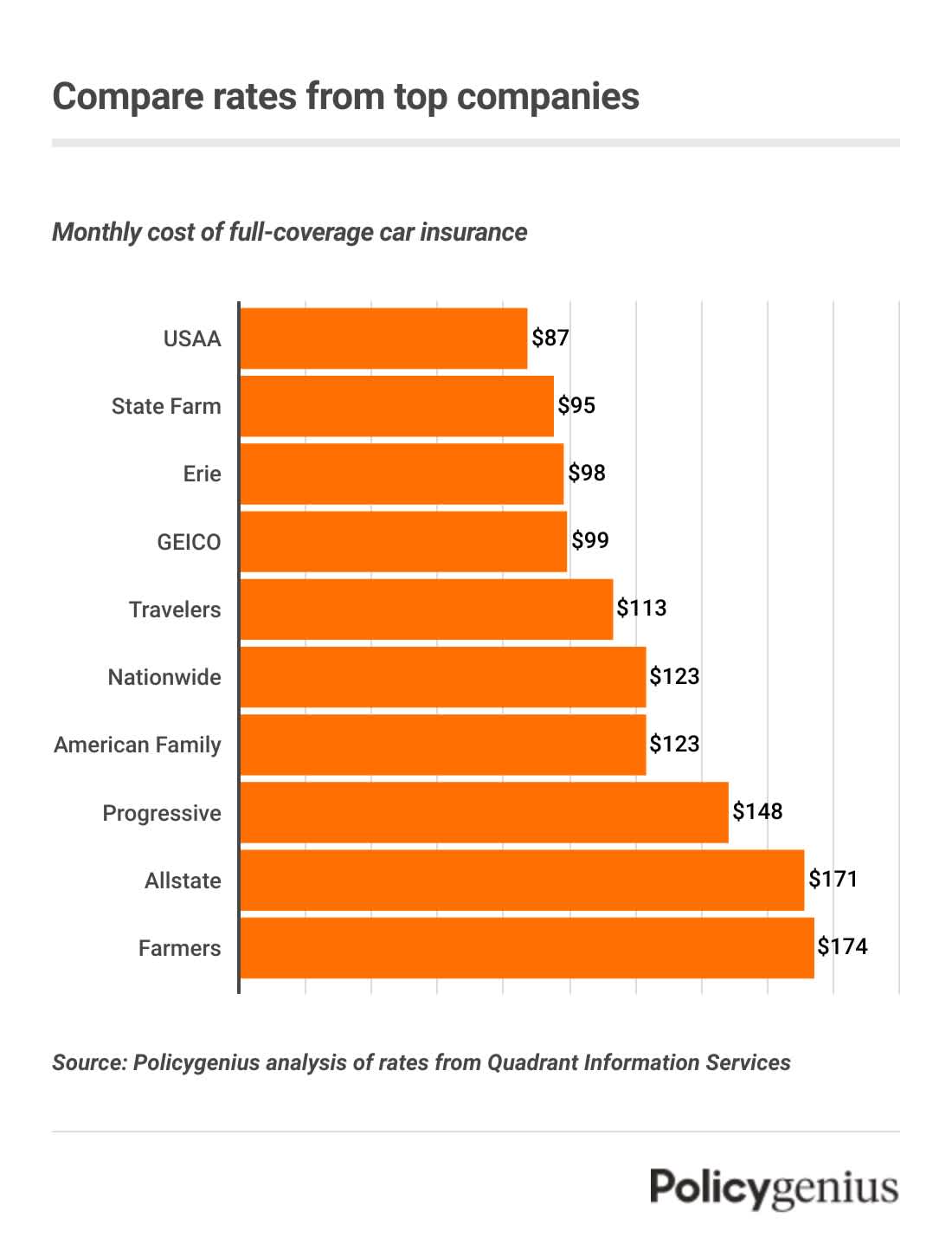

- Premium Costs: Evaluate the monthly premiums and assess your budget to ensure affordability.

- Claims Process: Research the claims process for each type of insurance, as a straightforward claims experience can save you time and stress when you need it most.

- CUSTOMER SERVICE: Assess the insurer's reputation for customer service so that you have support when navigating any issues.

By weighing these factors, you can make an informed decision that best protects you and your loved ones.

What Should You Look For in an Insurance Policy? Key Factors to Consider

When considering an insurance policy, it's crucial to assess several key factors to ensure you choose the best coverage for your needs. First and foremost, coverage limits are essential; they define how much the insurance company will pay in the event of a claim. Make sure to evaluate the deductibles as well, which is the amount you need to pay out-of-pocket before the policy kicks in. Additionally, you should consider the type of policy exclusions that may apply, as these can significantly impact your coverage. An analysis of the premium costs is also vital; higher coverage may come with higher premiums, so striking a balance is key.

Another important factor to consider is the reputation of the insurance provider. Research customer reviews and ratings, as they can give you insight into how well the company handles claims and customer service. Look for policies with flexible options that allow you to customize your coverage to fit your unique situation. Furthermore, consider whether the insurance company offers discounts for bundling policies or maintaining a claims-free record. Finally, always read the terms and conditions carefully to avoid any surprises in the fine print.