Tube Rank: Your Guide to Video Success

Discover tips and insights for optimizing your video presence.

Is Your Gold Investment a Glittering Opportunity or Fool's Gold?

Discover if your gold investment is a shining opportunity or just fool's gold. Uncover the truth behind your financial choices today!

The Pros and Cons of Investing in Gold: Is It Worth It?

Investing in gold has long been considered a safe haven for wealth preservation and diversification. One of the major pros of investing in gold is its ability to act as a hedge against inflation. As the cost of living rises, the value of gold typically appreciates, helping investors maintain their purchasing power. Additionally, gold is a tangible asset that can offer security in times of economic uncertainty. Unlike stocks and bonds, it is not subject to the same risks of market volatility and can provide a sense of stability in an investment portfolio.

However, there are notable cons to consider when investing in gold. One significant drawback is the lack of income generation; gold does not pay dividends or interest, meaning your returns are solely reliant on price appreciation. Furthermore, the storage and insurance of physical gold can incur additional costs, impacting overall profitability. Investors must also be aware of potential market fluctuations, as gold prices can be influenced by economic factors and geopolitical tensions. In conclusion, while investing in gold can be a beneficial strategy for some, it is important to weigh both the advantages and disadvantages to determine if it aligns with your financial goals.

How to Distinguish Between Genuine Gold Investments and Fool's Gold

Investing in gold can be a lucrative opportunity, but it's crucial to distinguish between genuine gold investments and fool's gold. Genuine gold, typically marked with a karat stamp such as 24K, 18K, or 14K, signifies its purity and value. In contrast, fool's gold, or pyrite, often resembles gold in color but carries little to no intrinsic value. To ensure you're making a wise investment, always look for reputable dealers, check for certifications, and request verification of the gold's authenticity. A simple acid test can also help determine the metal's quality.

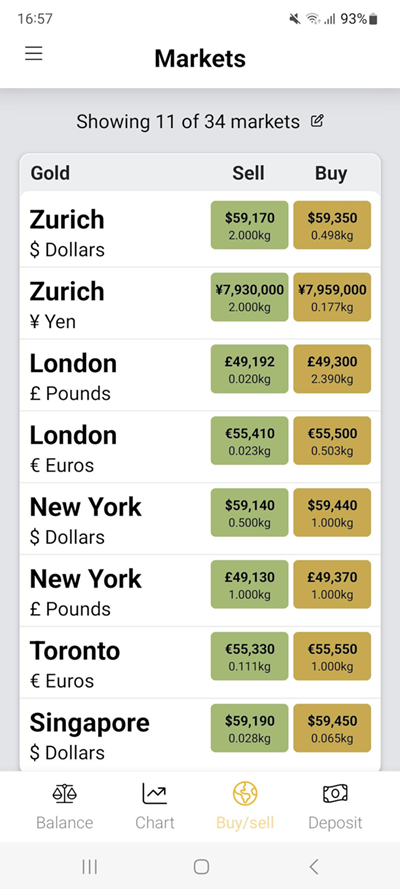

In addition to physical characteristics, understanding market trends can help in identifying genuine gold investments. Keep an eye on gold prices through financial news, as well as historical price data, to better assess the potential for appreciation. Furthermore, join forums or investment groups that focus on precious metals, where experienced investors share insights and advice. Staying informed and vigilant is key to avoiding the pitfalls of investing in fool's gold and ensuring that your investments can withstand market fluctuations.

Is Gold a Safe Haven or a Risky Bet? Understanding Market Trends

When considering whether gold is a safe haven or a risky bet, it is essential to analyze current market trends and economic indicators. In times of uncertainty, such as during economic downturns or geopolitical tensions, investors often flock to gold as a means of preserving their wealth. Historically, gold has maintained its value over the long term, especially when inflation rises or when currency values decline. However, the volatility of the gold market can make it a double-edged sword; while it can offer protection in turbulent times, it can also experience significant price fluctuations that may lead to substantial losses.

To truly understand the nature of gold as an investment, one must consider the dual nature of the asset class. On one hand, gold is often viewed as a non-correlated asset that can diversify a portfolio, especially in times of crisis. On the other hand, when markets stabilize and economic conditions improve, gold prices may stagnate or decline as investors shift their focus to riskier assets. Thus, whether gold serves as a safe haven or a risky bet greatly depends on the broader economic landscape and individual investor strategies. Some key factors to monitor include interest rates, inflation rates, and global political stability, all of which impact demand for gold.