Tube Rank: Your Guide to Video Success

Discover tips and insights for optimizing your video presence.

Mysterious Clauses: What Your Insurance Policy Isn't Telling You

Uncover hidden traps in your insurance policy! Discover the mysterious clauses that could cost you big when disaster strikes.

Uncovering Hidden Gems: 5 Surprising Clauses in Your Insurance Policy

Insurance policies can often feel overwhelming, but they may hold hidden gems that can benefit you in unexpected ways. In this article, we will uncover 5 surprising clauses that might be buried in the fine print of your insurance policy. From coverage for identity theft to clause exclusions that may save you money, understanding these aspects can help you make the most of your insurance investment. Let’s dive into the details and reveal what your policy may be hiding.

1. Identity Theft Protection: Many insurance policies offer coverage for expenses related to identity theft, including legal fees and lost wages.

2. Pet Injury Coverage: If your pet is injured in an accident, some policies may cover veterinary costs.

3. Home Office Coverage: If you work from home, your home insurance may cover office equipment and supplies.

4. Additional Living Expenses: In case of a disaster, some policies provide funds for temporary housing.

5. Coverage for Spoiled Food: Certain policies cover food spoilage due to power outages.

By being aware of these surprising clauses, you can take full advantage of the protections your insurance offers.

Are You Covered? Debunking Common Myths About Insurance Policies

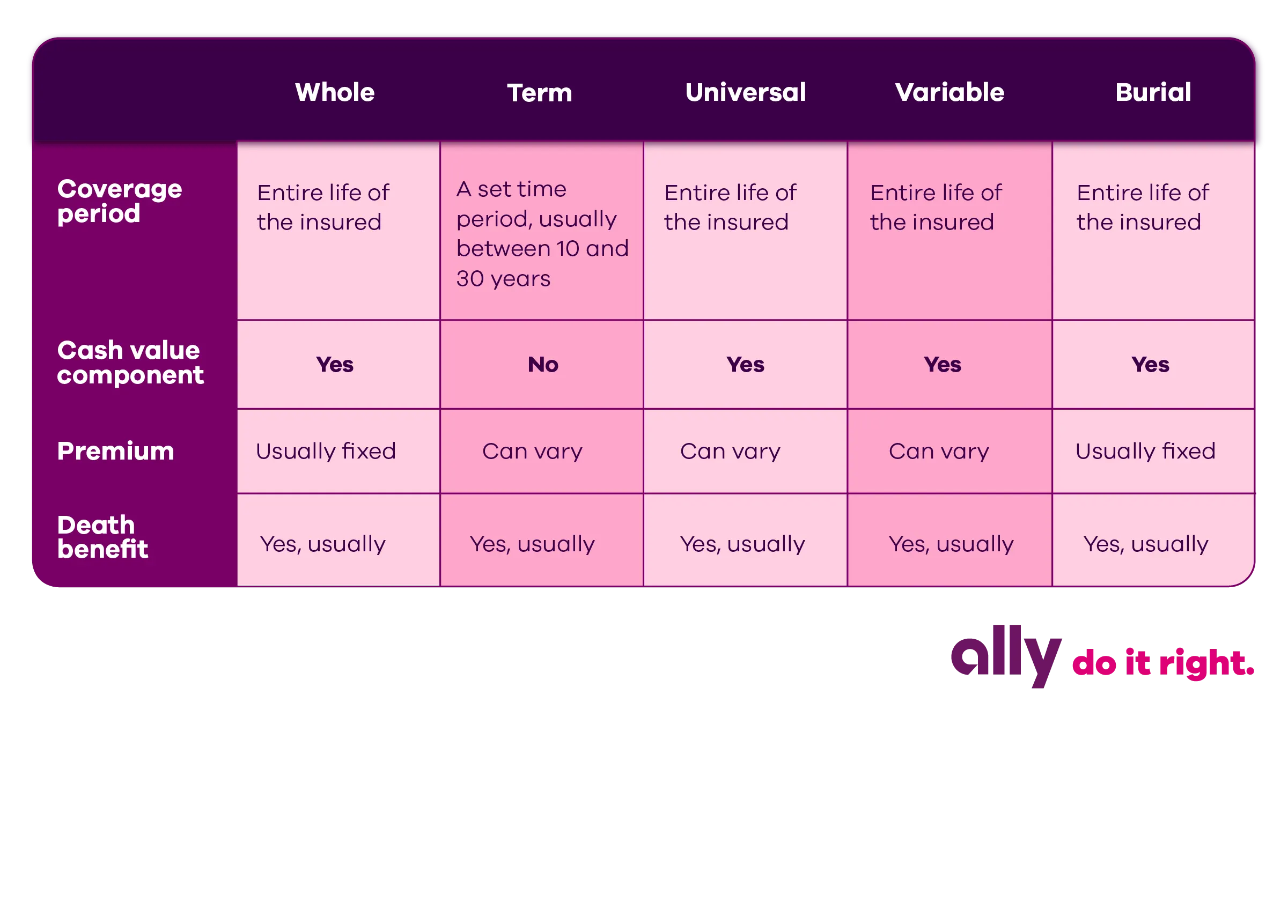

When considering insurance policies, many people fall prey to common misconceptions that can lead to serious financial consequences. One prevalent myth is that insurance policies are all the same; however, there are vast differences in coverage, exclusions, and costs among various types. For instance, auto insurance is tailored to protect you from vehicle-related incidents, while homeowners insurance covers damages to your property. Understanding these distinctions is crucial in selecting the right policy for your needs.

Another widespread myth is that once you have an insurance policy, you no longer need to make changes. This is far from the truth. Life events such as marriage, purchasing a new home, or starting a business can significantly impact your coverage requirements. It's essential to review and adjust your policies regularly to ensure that you have the necessary protections in place. Ignoring these changes can leave you underinsured and potentially facing devastating out-of-pocket expenses.

What Your Insurance Agent Might Not Tell You: Important Fine Print Explained

Understanding your insurance policy can often feel overwhelming, especially when it comes to the fine print. An insurance agent may present you with a polished overview, but important details can be hidden within the policy. For instance, terms such as "deductibles," "exclusions," and "coverage limits" are crucial to comprehend before signing on the dotted line. These elements dictate how much you’ll pay out of pocket in case of a claim and may specify situations not covered under your policy. It’s essential to ask your agent about these specifics, as they might not volunteer all the nuances.

Additionally, renewal terms can significantly affect your insurance experience. Many policies will automatically renew, but the terms and costs can change without clear communication from your agent. Be sure to request clarity regarding premium increases upon renewal and what factors might influence these changes. Understanding your rights as a policyholder, including how to challenge rate increases or file a complaint, is vital for your long-term satisfaction with your insurance provider.