Tube Rank: Your Guide to Video Success

Discover tips and insights for optimizing your video presence.

Renters Insurance: The Secret Safety Net You Didn't Know You Needed

Discover why renters insurance is the safety net you're missing! Protect your belongings and find peace of mind today.

What Does Renters Insurance Cover? 5 Key Protections You Should Know

When renting a home or apartment, many renters overlook the importance of renter's insurance. This insurance policy offers crucial financial protection against various unforeseen events. Generally, renter's insurance covers personal property loss due to situations such as fire, theft, or vandalism. Additionally, it provides liability coverage if someone gets injured within your rented premises, meaning that you won’t be held financially responsible for unexpected accidents.

Here are five key protections that renter's insurance typically includes:

- Personal Property Coverage: This protects your belongings, like furniture and electronics, from covered perils.

- Liability Protection: If someone is injured or their property is damaged due to your negligence, this coverage helps cover legal expenses.

- Additional Living Expenses: If your rented property becomes uninhabitable due to a covered event, this pays for temporary housing and associated costs.

- Medical Payments Coverage: This covers medical expenses for guests injured in your home, regardless of fault.

- Coverage for Identity Theft: Some policies now offer assistance and financial protection if your identity is stolen.

Top 10 Myths About Renters Insurance Debunked

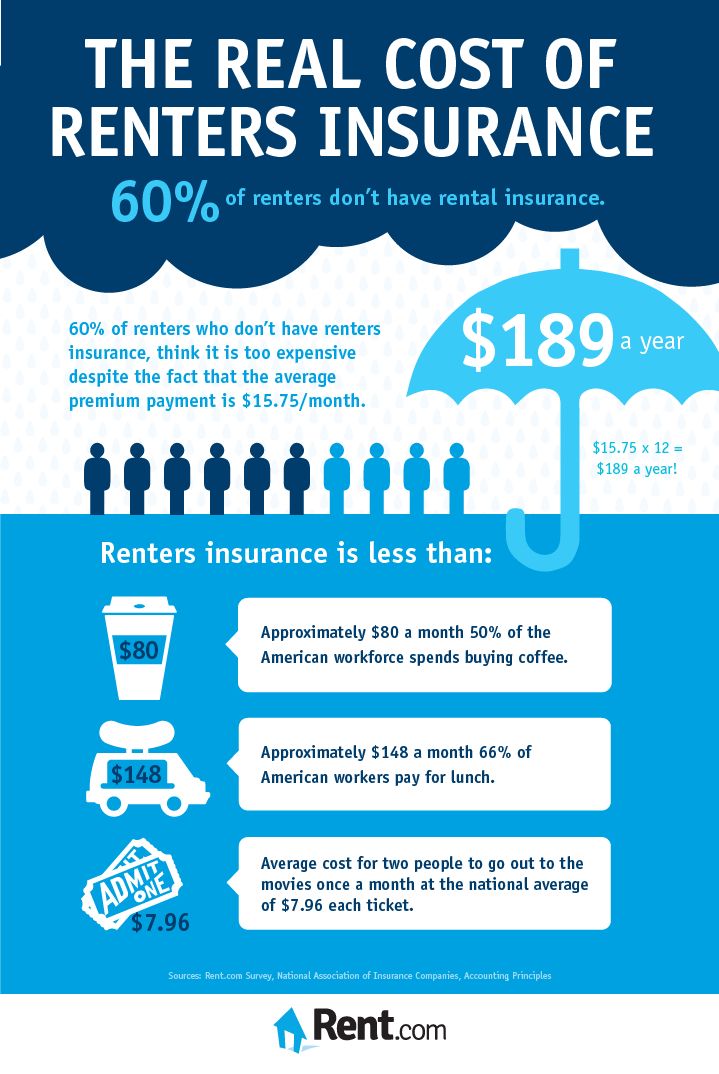

When it comes to renters insurance, many myths can lead to misunderstandings about its importance and value. One common misconception is that renters insurance is unnecessary if you are renting a property and your landlord has insurance. However, this is not true. Landlord's insurance typically only covers the building itself, leaving the personal belongings of tenants unprotected. In reality, renters insurance provides essential coverage for your possessions, should they be damaged or stolen, making it an important safeguard for anyone renting a home.

Another prevalent myth is that renters insurance is too expensive. In truth, the average cost of renters insurance can be quite affordable, often ranging from $15 to $30 per month, depending on coverage levels and location. Furthermore, many insurance providers offer discounts for bundling policies, such as combining renters insurance with auto insurance. Understanding the true costs and benefits can help tenants see that investing in this type of coverage is a reasonable and wise decision.

Is Renters Insurance Worth It? A Comprehensive Cost-Benefit Analysis

When considering whether renters insurance is worth it, it's essential to conduct a thorough cost-benefit analysis. On average, renters insurance can cost between $15 to $30 per month, depending on factors such as location and coverage amount. In exchange for this relatively low monthly cost, tenants receive financial protection for their personal belongings, liability coverage for incidents that occur within their rented space, and additional living expenses if their home becomes uninhabitable due to covered events. This means that in the event of theft, fire, or water damage, the financial repercussions can be significantly mitigated.

Moreover, the peace of mind that comes with renters insurance is invaluable. Not only does it protect your personal property, but it also covers personal liability, which can save you from substantial out-of-pocket expenses in the case of accidents or injuries that occur in your home. Additionally, many landlords now require tenants to have insurance as part of the lease agreement, making it a practical necessity. Ultimately, the small investment in renters insurance can offer substantial financial security, making it a worthy consideration for anyone renting a living space.