Tube Rank: Your Guide to Video Success

Discover tips and insights for optimizing your video presence.

Save Big on Auto Insurance: Discover Discounts You Didn't Know Existed

Unlock hidden auto insurance discounts and start saving big today! Don’t miss out on money-saving tips that could change your premiums forever!

Unlock Hidden Savings: The Top 10 Auto Insurance Discounts You May Be Missing

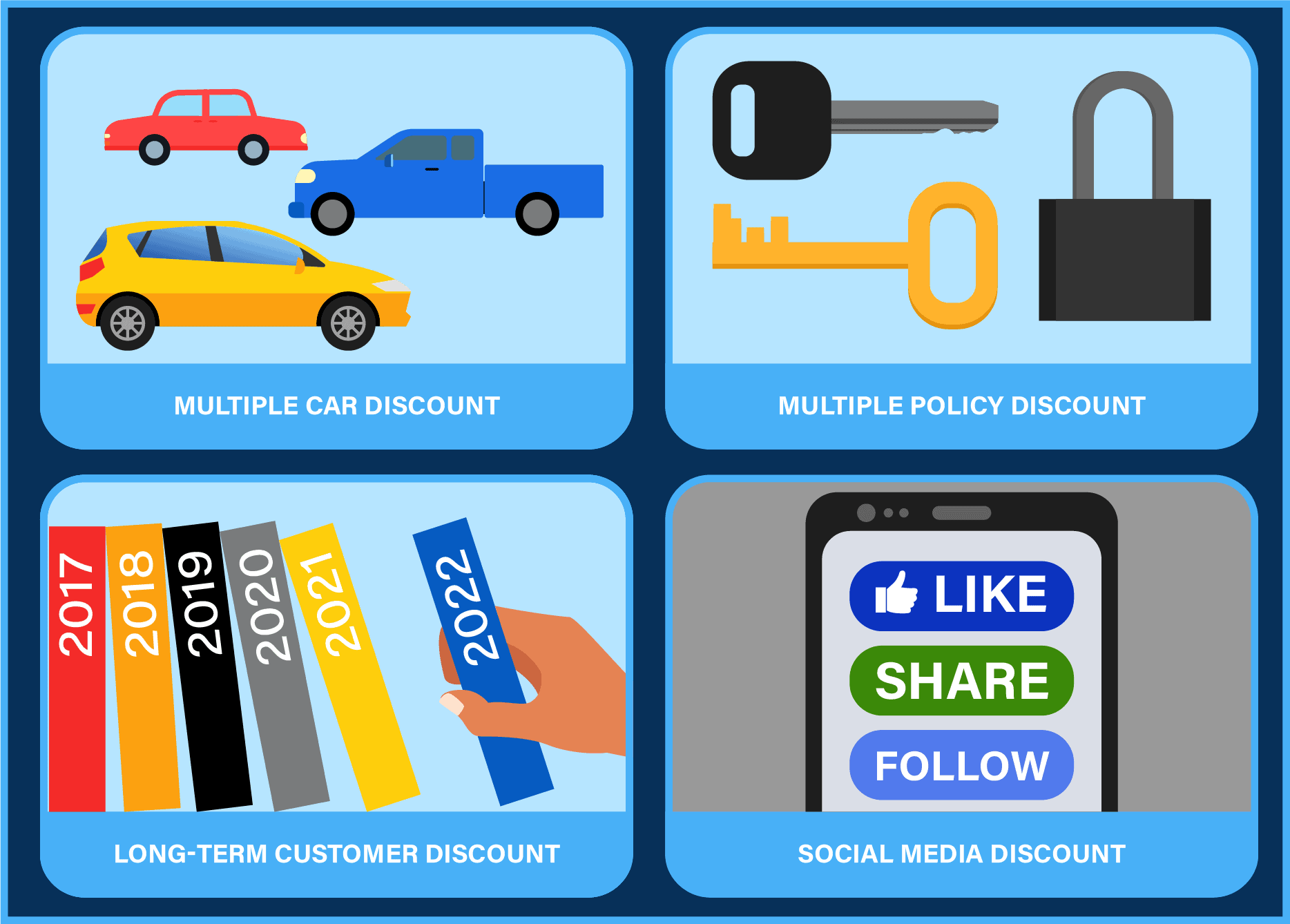

When it comes to auto insurance, many drivers are unaware of the wide array of discounts that could significantly reduce their premiums. Unlock hidden savings by taking advantage of these savings opportunities that can lower your costs without sacrificing coverage. From multi-policy discounts to safe driver incentives, understanding what discounts are available can help you keep more money in your pocket. Here are the top 10 auto insurance discounts you may be missing:

- Safe Driver Discount: Maintain a clean driving record free of accidents and violations.

- Multi-Policy Discount: Bundle your auto insurance with your home or other policies.

- Good Student Discount: Students with good grades often qualify for reduced rates.

- Military Discount: Active and retired military personnel may receive special rates.

- Low Mileage Discount: Drive less than average miles to qualify for lower premiums.

- Defensive Driving Course Discount: Complete a certified course to prove your driving skills.

- Pay-in-Full Discount: Save money by paying your premium in a single payment.

- Vehicle Safety Features Discount: Cars equipped with advanced safety features may qualify for savings.

- Affiliate Discounts: Join certain organizations or groups that offer auto insurance perks.

- Claims-Free Discount: Go a certain period without filing a claim to enjoy reduced rates.

Are You Paying Too Much? A Guide to Lesser-Known Auto Insurance Discounts

When it comes to auto insurance, many drivers often overlook valuable discounts that could significantly reduce their premiums. Are you paying too much? It's a question worth considering, especially if you're not actively seeking out the lesser-known auto insurance discounts available to you. For example, insurance companies frequently offer discounts for safe driving records, bundling multiple policies, or being a member of certain professional organizations. However, there are additional options that many consumers are unaware of, such as discounts for low annual mileage or completion of defensive driving courses, which can save you money on your premiums.

To get a better handle on potential savings, start by reaching out to your insurance provider and inquiring about all available discounts. Here are a few that you may find surprising:

- Good Student Discount: High school and college students who maintain a good GPA could save significantly on their premiums.

- Military or Veteran Discounts: Many insurers offer discounts as a gesture of appreciation for service members.

- Green Vehicle Discount: If you drive a hybrid or electric vehicle, you might qualify for a discount.

Don't hesitate to conduct thorough research and compare quotes; finding these hidden gems can prevent you from asking yourself in the future, Are you paying too much?

The Ultimate Checklist: Maximize Your Auto Insurance Savings with These Discounts

When it comes to maximizing your auto insurance savings, knowing the various discounts available can make a significant difference in your monthly premium. Start by checking if you're eligible for multi-policy discounts. If you bundle your auto insurance with homeowners or renters insurance, many providers will offer a reduced rate. Additionally, pay close attention to good driver discounts. If you have a clean driving record with no accidents or traffic violations, you may qualify for lower rates. Other discounts to consider include those for student drivers, military service members, and low mileage drivers.

Another essential part of your auto insurance savings checklist is understanding the impact of your vehicle choice on your premiums. Cars with advanced safety features or those rated highly for safety can often secure lower insurance rates. Be sure to inquire about loyalty discounts as well; if you've been with the same insurer for several years, they may reward your loyalty with reduced rates. Lastly, don’t forget to ask about discounts for paying annually instead of monthly, as many companies offer savings for lump-sum payments. By taking the time to explore these options, you can ensure that you're receiving the best possible rate on your auto insurance.