Tube Rank: Your Guide to Video Success

Discover tips and insights for optimizing your video presence.

Term Life Insurance: Your Safety Net for Life’s Curveballs

Discover how term life insurance can be your ultimate safety net against life's unexpected twists. Secure peace of mind today!

Understanding Term Life Insurance: Key Benefits and Features

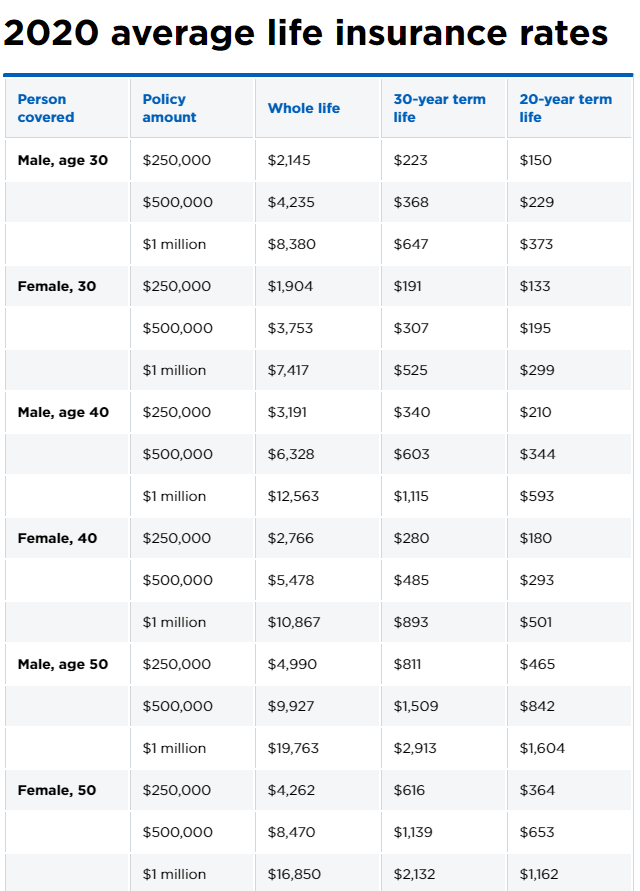

Term life insurance is a popular choice for many individuals seeking affordable life coverage for a specific period. One of the key benefits of term life insurance is its cost-effectiveness; premiums are generally lower compared to whole life policies. It provides a straightforward approach to financial security, allowing policyholders to select coverage that aligns with specific needs, such as raising children, paying off a mortgage, or planning for retirement. Moreover, many term life policies offer flexible terms, allowing options for 10, 20, or even 30 years of coverage, catering to varied financial situations.

Another significant feature of term life insurance is the simplicity in its structure. Unlike investment-focused policies, term life primarily offers a death benefit, which means that beneficiaries receive a payout if the insured passes away during the term. This clarity makes it easier for individuals to understand what they are paying for without the complexities of cash value accumulation. Additionally, many policies provide the option to convert to permanent coverage at the end of the term, ensuring continued protection without the need for requalification. This adaptability makes term life an excellent choice for those looking for both affordability and long-term security.

Is Term Life Insurance Right for You? 5 Questions to Consider

Determining whether term life insurance is right for you involves considering your personal financial situation, your family's needs, and how you plan for the future. Unlike whole life insurance, which covers you for your entire life, term life insurance provides coverage for a specific period, typically ranging from 10 to 30 years. This can be particularly appealing if you have temporary financial obligations, such as a mortgage or children's education. To help clarify this decision, here are five essential questions to reflect on:

- What are your financial responsibilities and future needs?

- How long do you need coverage?

- Can you afford the premiums?

- Are there other financial resources available to your dependents?

- What is your health status?

By answering these questions, you can gain a clearer perspective on whether term life insurance aligns with your overall financial strategy and future goals.

How Term Life Insurance Provides Financial Security for Your Loved Ones

Term life insurance is designed to provide a safety net for your loved ones in the event of your untimely passing. By selecting a specific term—typically ranging from 10 to 30 years—you can secure a death benefit that can replace lost income, pay off debts, or cover future expenses such as education for your children. This type of insurance offers financial peace of mind, ensuring that your family can maintain their lifestyle and meet their obligations without the added stress of financial strain during a difficult time.

One of the key advantages of term life insurance is its affordability compared to permanent life insurance policies. Many individuals find that they can purchase a significant amount of coverage for a relatively low premium, making it an accessible option for families. In the event of your death, the policy pays out a predetermined sum, which can be utilized for various essential needs, such as

- Mortgage payments

- Childcare expenses

- Emergency funds