Tube Rank: Your Guide to Video Success

Discover tips and insights for optimizing your video presence.

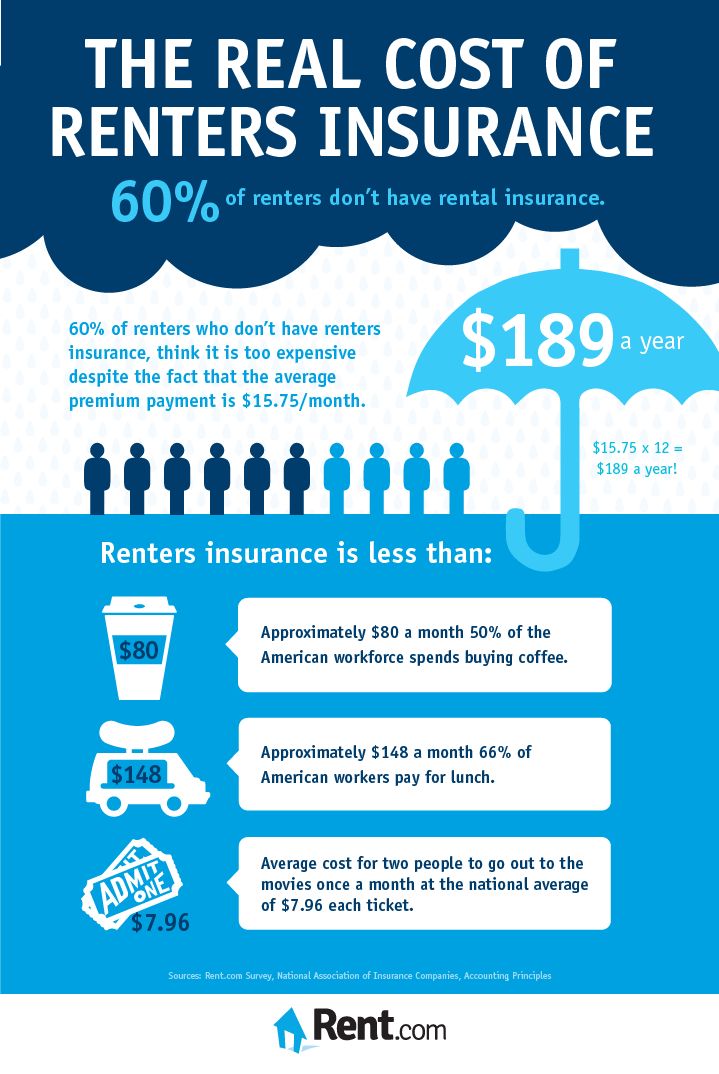

Think You're Safe? The Real Cost of Skipping Renters Insurance

Discover the hidden dangers of not having renters insurance and why you can't afford to skip it. Protect yourself today!

Why Skipping Renters Insurance Could Cost You Thousands

Renters insurance may seem like an unnecessary expense to some, but the reality is that forgoing this vital coverage could lead to significant financial repercussions. In the event of unforeseen circumstances—such as fire, theft, or natural disasters—having renters insurance can help protect your personal property and offset the costs of replacing lost or damaged belongings. For instance, if you own electronics, furniture, or clothing, the out-of-pocket costs to replace these items can add up quickly, potentially running into the thousands. Without renters insurance, you would be solely responsible for these expenses, leaving you financially vulnerable.

Moreover, many renters are unaware that liability coverage is often included in renters insurance policies. This aspect of coverage is crucial; it protects you against legal claims arising from accidents that might occur in your rental unit, such as a guest being injured due to a fall. If you are found liable, medical bills and legal fees can skyrocket. According to estimates, a single liability claim could exceed your deductible, resulting in thousands of dollars in expenses. Therefore, skipping rent insurance not only jeopardizes your personal belongings but can also expose you to significant financial risk over time.

The Hidden Risks of Being Uninsured: What Every Renter Should Know

Being uninsured carries significant risks that many renters may not fully understand. Without insurance, you are leaving yourself vulnerable to financial burdens that can arise from unforeseen circumstances, such as theft, fire, or water damage. For instance, if a fire breaks out in your apartment complex, the costs of replacing your belongings can quickly add up. Additionally, you could be held liable for damages to your landlord's property or injuries sustained by visitors in your unit. The peace of mind that comes with having coverage is invaluable and can save renters from disaster.

Furthermore, the hidden risks of being uninsured extend beyond immediate incidents. Many landlords now require renters to have insurance as part of the lease agreement to protect both parties. If you do not have coverage, you may face difficulties in securing your rental application or be at a disadvantage in negotiations. Here are a few additional risks to consider:

- Liability for personal or property damage to others

- Loss of personal belongings in cases of unexpected events

- Increased stress and financial struggle during emergencies

Is Renters Insurance Worth It? Debunking Common Myths

When weighing the pros and cons of renters insurance, many individuals fall prey to common myths that may cloud their judgment. One prevalent misconception is that renters insurance is unnecessary because landlords' policies cover everything. In reality, a landlord’s insurance typically only covers the building and their liability, not your personal belongings or any liability you may incur as a tenant. This leads us to the first important point: renters insurance protects your personal property from events like theft, fire, and water damage. Without it, you could face significant financial loss in the wake of an unexpected incident.

Another myth is that renters insurance is too expensive for most budgets. However, the truth is that renters insurance is often quite affordable, averaging around $15 to $30 per month depending on coverage limits and location. This small monthly premium can save you thousands of dollars in the event of a tragedy, making it an intelligent financial investment. It’s also worth mentioning that many policies include additional benefits, such as liability coverage and temporary living expenses if you need to relocate due to a covered loss. So, debunking these myths reveals that renters insurance is not only worth it but also an essential safety net for your financial wellbeing.