Tube Rank: Your Guide to Video Success

Discover tips and insights for optimizing your video presence.

Whole Life Insurance: The Guaranteed Hug Your Family Needs

Discover why Whole Life Insurance is the ultimate safety net for your family—secure their future with a guaranteed hug today!

Understanding Whole Life Insurance: Key Benefits for Your Family

Whole life insurance is a type of permanent life insurance that provides both a death benefit and a cash value component. This dual benefit ensures that not only is your family financially protected in the event of your passing, but they can also access a growing cash value during your lifetime. The premiums you pay for whole life insurance are generally fixed, offering a sense of stability in your financial planning. Understanding the mechanics of this insurance type can help you provide long-term security for your loved ones.

One of the key benefits of whole life insurance is its ability to build cash value over time, which can be borrowed against in times of need. This can serve as a source of emergency funds or supplemental retirement income. Additionally, the death benefit is typically tax-free for your beneficiaries, ensuring that your family receives the full amount intended for them without tax burdens. To summarize, the main benefits include:

- Permanent coverage for your entire life

- Fixed premiums that won't increase

- Cash value growth that you can access

- Tax-free death benefits for your family

Is Whole Life Insurance Right for You? Exploring Your Options

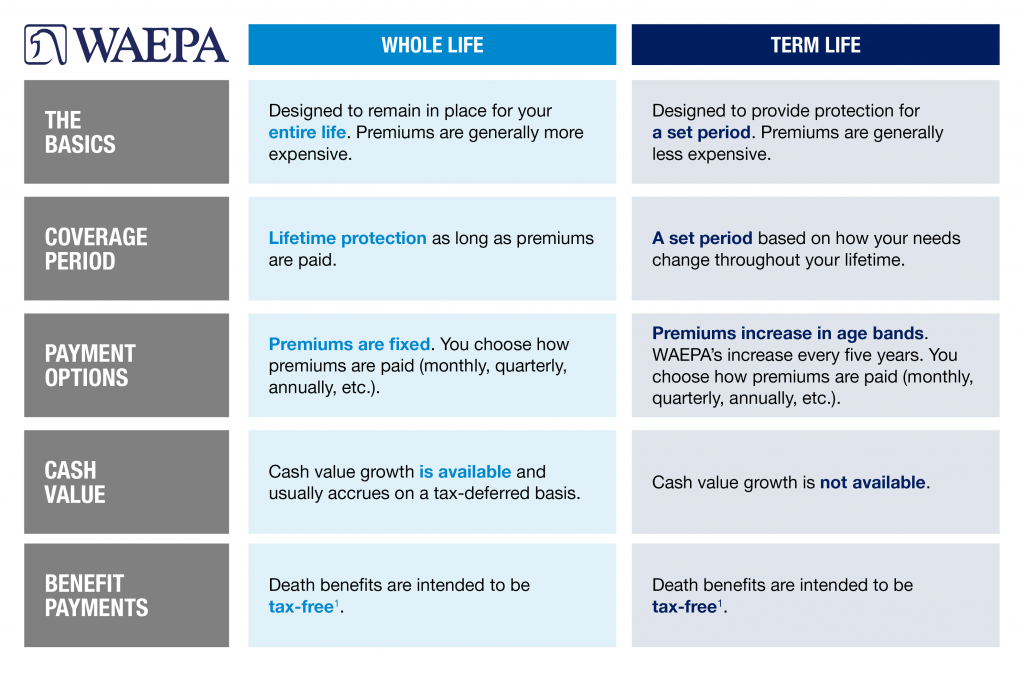

Whole life insurance is a type of permanent life insurance that provides coverage for your entire lifetime, as long as the premiums are paid. Unlike term life insurance, which only covers you for a specified period, whole life insurance builds cash value over time, making it an appealing option for those looking for both insurance coverage and a savings component. When considering whether whole life insurance is right for you, it's important to evaluate your financial goals, your family’s needs, and your ability to commit to long-term premium payments. Understanding these factors will help you determine if this type of policy aligns with your financial plan.

Before making a decision, it may be beneficial to explore other options alongside whole life insurance. For instance, term life insurance is often more affordable and can provide the necessary coverage for a specific period, such as until your children are financially independent. On the other hand, hybrid options like universal life insurance can offer more flexibility regarding premiums and death benefits. Weighing these alternatives will empower you to make an informed choice about whether whole life insurance is indeed the best fit for your personal and financial circumstances.

How Whole Life Insurance Provides Financial Security for Your Loved Ones

Whole life insurance offers a unique financial safety net that ensures your loved ones are secure in the event of your passing. Unlike term life insurance, which provides coverage for a specified period, whole life policies offer lifelong protection, making them an essential part of financial planning. This type of insurance not only guarantees a death benefit that allows your beneficiaries to cover daily expenses, debts, and funeral costs but also accumulates cash value over time. As a result, policyholders can tap into this cash value during their lifetime for various purposes, such as funding education or paying off a mortgage, contributing to long-term financial stability.

Moreover, the predictable nature of whole life insurance premiums enhances its appeal. With fixed premium payments, you won't face unexpected increases, allowing for better budgeting and planning. This stability helps establish a legacy of financial security, ultimately benefiting your family. In addition, the death benefit provided to beneficiaries is generally tax-free, adding another layer of financial advantage to whole life insurance. By choosing a whole life policy, you are taking a crucial step in ensuring that your loved ones are cared for, no matter what the future holds.