Tube Rank: Your Guide to Video Success

Discover tips and insights for optimizing your video presence.

Whole Life Insurance: The Never-Ending Money Machine

Unlock the secret to wealth with whole life insurance—your never-ending money machine! Discover how it works today!

Understanding Whole Life Insurance: How It Works as a Financial Tool

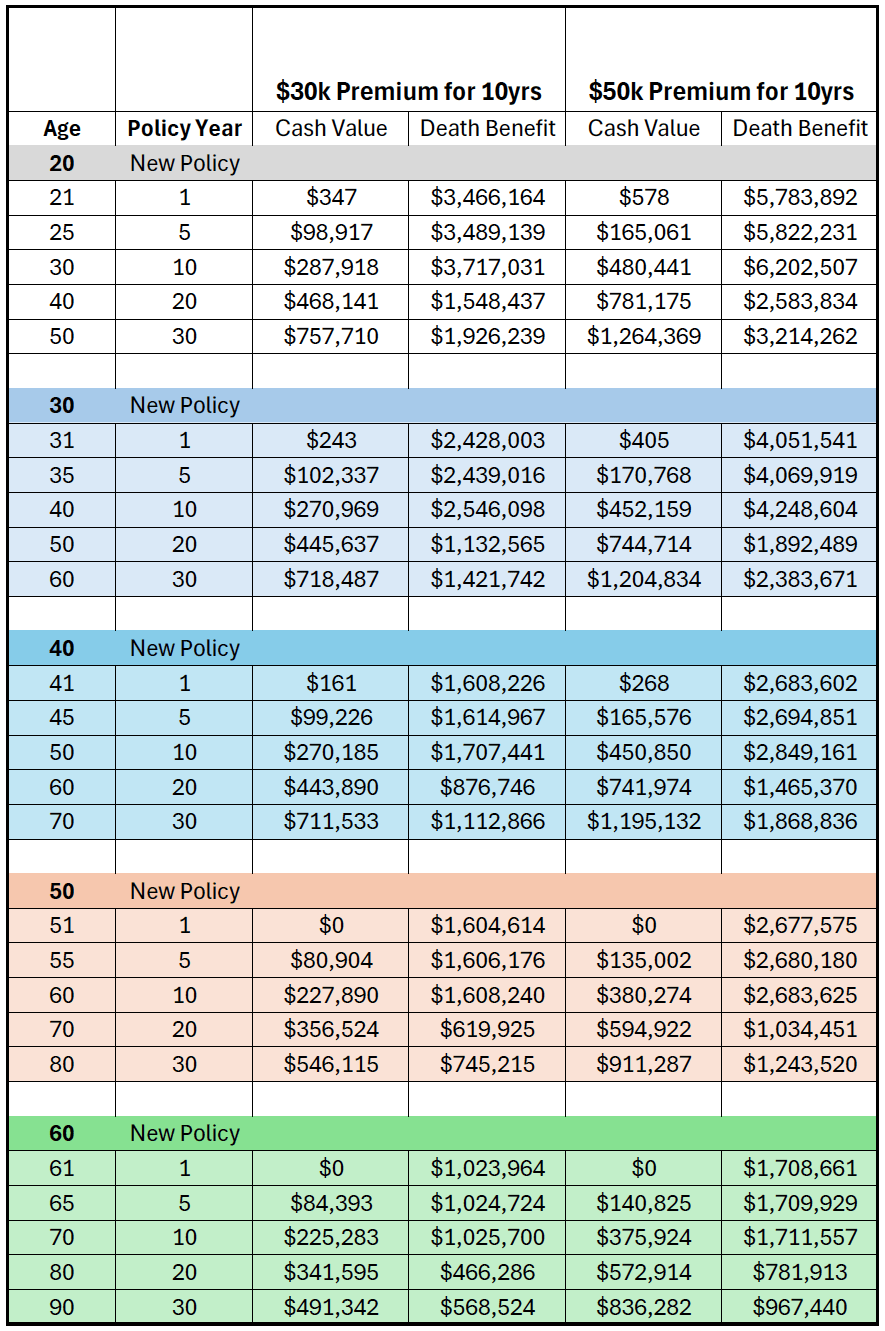

Whole life insurance is much more than just a policy that provides a death benefit; it is a versatile financial tool that can be used for various purposes over the lifetime of the insured. Unlike term insurance, which only offers coverage for a specified period, whole life policies remain in effect for the entire life of the policyholder, as long as premiums are paid. This kind of insurance combines a death benefit with a cash value component that grows over time, making it a popular choice for individuals seeking long-term financial stability. The cash value accumulates on a tax-deferred basis, allowing policyholders to tap into this resource for financial needs, retirement funding, or even emergency expenses.

Moreover, whole life insurance can serve as a crucial part of an overall estate planning strategy. The death benefit paid to beneficiaries is generally tax-free, which can provide financial security for loved ones. Additionally, policyholders can borrow against the cash value of their policy, usually at low-interest rates, further enhancing the utility of whole life as a financial tool. By understanding the mechanics of whole life insurance and how it integrates with personal finance goals, individuals can make informed decisions that benefit their long-term financial health.

Top 5 Benefits of Whole Life Insurance: Why It's More Than Just a Policy

Whole life insurance offers numerous benefits that extend beyond the primary function of providing death benefits to your beneficiaries. One of the key advantages is the cash value component, which grows over time at a guaranteed rate. This means that not only does your policy provide financial security for your loved ones, but it also serves as a form of savings that accumulates value. The cash value can be borrowed against or withdrawn in times of need, making it a flexible option for those looking to maintain financial stability during unexpected circumstances.

Additionally, whole life insurance features level premiums, ensuring that your payments remain consistent throughout the life of the policy. This predictability is beneficial for budgeting and financial planning. Moreover, the policy can contribute to your long-term estate planning, offering your heirs a financial legacy while potentially avoiding estate taxes. In summary, the top benefits of whole life insurance encapsulate not only protection but also a valuable financial asset for both you and your family.

Is Whole Life Insurance Right for You? Key Questions to Consider

When considering whether whole life insurance is right for you, it's essential to evaluate your long-term financial goals and needs. Whole life insurance offers a blend of life coverage and a cash value component that grows over time. Start by asking yourself some key questions: Are you looking for lifelong coverage? If your answer is yes, whole life insurance may be a suitable option. Additionally, consider whether you can afford the higher premiums associated with this type of policy compared to term life insurance.

Another critical aspect to ponder is how you plan to use the cash value that accumulates in your whole life insurance policy. This cash value can serve as an emergency fund, supplement retirement income, or even provide funds for major expenses. However, it’s vital to understand that accessing this cash value may impact your death benefit, so consider your priorities carefully. Ultimately, assessing your personal circumstances and financial aspirations will help you determine if whole life insurance aligns with your needs.