Tube Rank: Your Guide to Video Success

Discover tips and insights for optimizing your video presence.

Why Picking Insurance is Like Dating: Finding Your Perfect Match

Discover why choosing insurance feels like dating and learn how to find your perfect match for peace of mind and security!

Navigating the Insurance Landscape: Tips for Finding Your Perfect Match

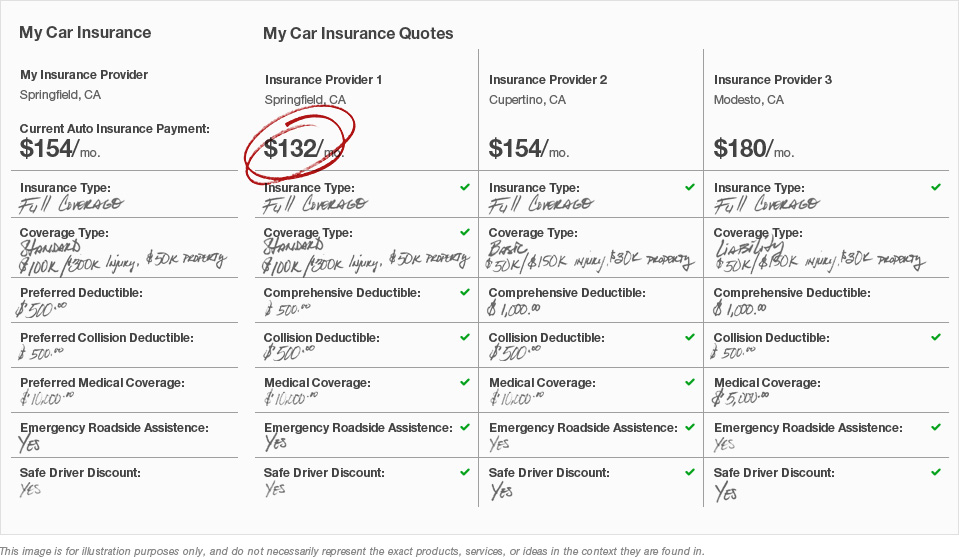

Navigating the insurance landscape can often feel overwhelming, but understanding a few key principles can help you find your perfect match. Start by assessing your individual needs—whether you require health, auto, home, or life insurance. Consider factors such as your age, lifestyle, and financial situation, as these will significantly influence the type of coverage that best suits you. You might find it helpful to create a list of your priorities and budget constraints, allowing you to compare options side by side.

Once you have a clearer understanding of your needs, it’s time to shop around. Researching multiple insurance providers is crucial in this process. Look for companies with strong customer reviews and financial stability to ensure reliability. Don’t hesitate to utilize online tools and resources that allow you to compare quotes and coverage plans. Additionally, consider reaching out to an insurance broker who can provide expert advice and help navigate the complex offerings in the market. By taking these steps, you'll be well on your way to confidently finding your perfect match in insurance.

Is Your Insurance Policy the One? Key Indicators to Look For

When evaluating whether your insurance policy is the right fit, it's crucial to consider several key indicators. First, assess the coverage options available. A good policy should provide comprehensive coverage that meets your specific needs, whether that pertains to health, auto, or homeowner's insurance. Look for policies that offer customizable options, allowing you to tailor the plan to your unique circumstances. Additionally, consider the limits and exclusions outlined in the policy. Understanding these factors helps ensure that you won't be caught off guard when you need to make a claim.

Another essential factor to contemplate is the claims process. An efficient and straightforward claims process is indicative of a reliable insurance provider. Research customer reviews and testimonials to gauge the experiences others have had when filing claims. It’s also wise to check the financial stability of the insurance company; a strong rating from a trusted agency can provide peace of mind that they will be able to pay out in the event of a claim. Ultimately, ensuring that your insurance policy aligns with your needs and expectations is key to achieving your peace of mind.

What Dating and Insurance Have in Common: A Guide to Making the Right Choice

When it comes to dating and insurance, making the right choice can feel overwhelming, much like navigating the complex world of relationships. Both require a careful evaluation of options, understanding your own needs, and considering the long-term implications of your choices. Just as you would assess compatibility and shared values in a partner, you must examine your coverage options and policy details in insurance. Key factors include premiums, deductibles, and coverage limits, mirroring the traits you value in a partner, such as trustworthiness and emotional support.

Furthermore, both dating and insurance necessitate a level of responsiveness and adaptability. In dating, as relationships progress, priorities may shift, requiring you to reevaluate your connections. Similarly, your insurance needs can change due to life events like marriage, home purchases, or family additions. Therefore, it is crucial to regularly review and update your insurance policies, just as you would check in on your relationship dynamics. This proactive approach ensures that you have the right protection in place and that you’re not settling for less in either arena.