Tube Rank: Your Guide to Video Success

Discover tips and insights for optimizing your video presence.

Why Your Landlord's Insurance Isn't Enough

Discover the hidden risks your landlord's insurance won't cover and protect your investment with the right policies!

Understanding the Limitations of Landlord's Insurance: What You're Missing

Understanding the limitations of landlord's insurance is crucial for property owners looking to protect their investments. While this type of insurance is designed to cover various risks associated with rental properties, such as property damage and liability claims, it often comes with significant exclusions. For instance, many policies do not cover damages caused by natural disasters like floods or earthquakes unless additional coverage is purchased. Furthermore, loss of rental income may not be included, leaving landlords vulnerable to financial loss during prolonged vacancies due to repairs or unforeseen circumstances.

Additionally, landlord's insurance typically does not cover tenant-related issues, such as eviction costs or damages caused by tenants themselves. This is an important factor that many landlords overlook when evaluating their insurance needs. To ensure comprehensive protection, it is advisable for landlords to review their policy details carefully and consider supplemental coverage options. By understanding these limitations, property owners can make informed decisions and take proactive steps to mitigate potential risks that could impact their rental business.

Is Your Landlord's Insurance Enough? Key Coverage Gaps You Need to Know

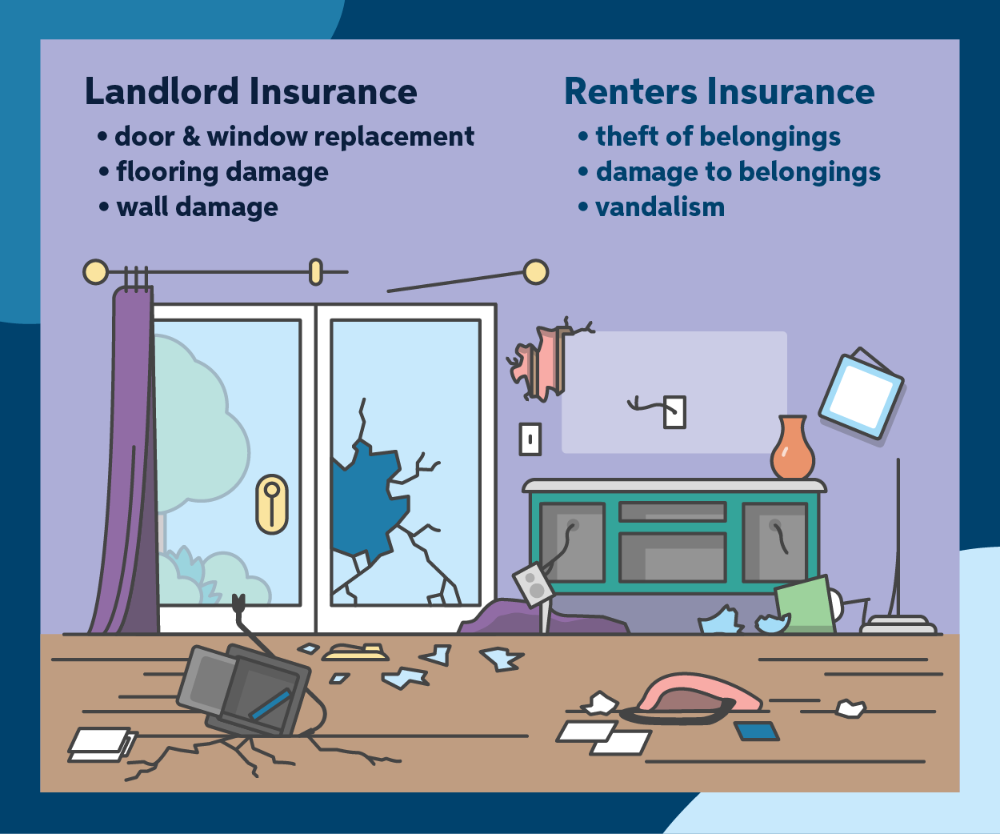

When it comes to renting a home, tenants often assume that their landlord's insurance provides comprehensive coverage for the property. However, it's crucial to recognize that landlord's insurance is primarily designed to protect the owner's investment and not the renter's belongings. Many landlords opt for basic policies, which may leave significant coverage gaps. These gaps can include liabilities for personal injury, damage to tenants' belongings, and additional living expenses in case of a property disaster. Therefore, as a tenant, it's essential to understand what is covered and what is not, ensuring you're adequately protected.

Here are some key coverage gaps you should investigate:

- Personal Property Coverage: Most landlord policies do not cover tenant personal belongings. Make sure to consider obtaining renter's insurance.

- Liability Coverage: Landlord insurance typically doesn't protect you from injuries occurring within your rented space. Reviewing a personal liability policy or extending coverage through your landlord may be necessary.

- Loss of Use: If your rental becomes uninhabitable, landlord insurance may cover lost rental income, but it won't help you find alternative living arrangements, which is a critical need for tenants.

What Additional Protections Should Every Landlord Consider Beyond Insurance?

While having insurance is crucial for landlords, it's not the only protection that should be considered to safeguard their investment. Legal protections such as rental agreements and lease clauses are essential in delineating the responsibilities of both the landlord and tenant. Drafting a comprehensive lease can help prevent disputes over security deposits, repairs, and property maintenance. Additionally, landlords should stay informed about local housing laws and regulations to ensure compliance and reduce the risk of legal issues arising from tenant disputes or evictions.

Another important layer of protection is implementing property security measures. This can include installing security cameras, proper lighting, and secure locks on all doors and windows. By taking proactive steps to enhance the safety and security of rental properties, landlords not only protect their asset but also attract more reputable tenants. Furthermore, conducting regular property inspections can identify maintenance issues before they escalate, ensuring both the property and tenant are well cared for.