Tube Rank: Your Guide to Video Success

Discover tips and insights for optimizing your video presence.

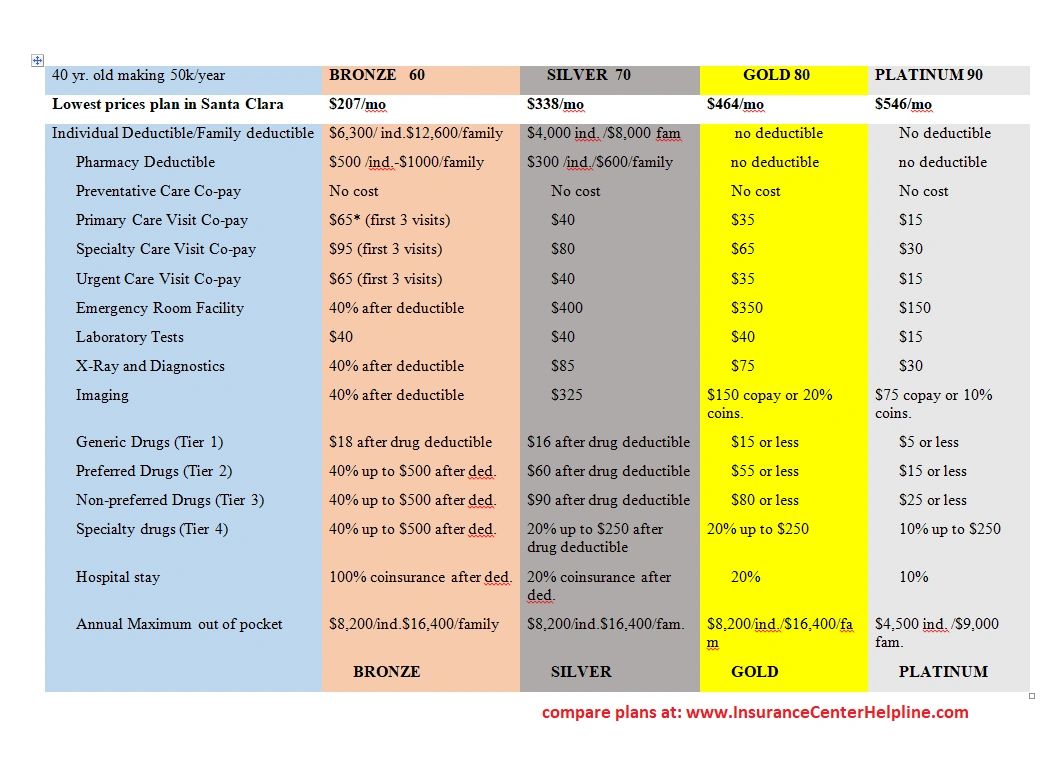

Insurance Showdown: Who's Got Your Back?

Uncover the truth in the Insurance Showdown! Discover which providers truly have your back and protect what matters most.

Understanding the Types of Insurance: What You Need to Know

Understanding the types of insurance available is crucial for making informed decisions about your financial future. Insurance serves as a safety net, protecting you against unexpected events that could lead to significant financial loss. The primary categories of insurance include health insurance, auto insurance, homeowner's insurance, and life insurance. Each type has its own unique features and purposes, designed to cover specific risks and provide peace of mind for policyholders.

When choosing the right type of insurance, it’s important to assess your personal needs and circumstances. Here are a few key considerations:

- Health Insurance: Covers medical expenses and is vital for accessing healthcare services.

- Auto Insurance: Protects against financial loss resulting from accidents involving vehicles.

- Homeowner's Insurance: Safeguards your home and belongings against damage or theft.

- Life Insurance: Provides financial support to your beneficiaries in the event of your passing.

Understanding these types is the first step in securing your financial well-being.

Insurance Premiums Explained: Why They Vary and How to Save

Insurance premiums are the payments policyholders make to maintain their insurance coverage, and understanding why these amounts can vary is crucial for anyone looking to make informed financial decisions. Factors affecting insurance premiums include age, location, driving history, and even credit scores. For example, a younger driver may face higher premiums due to a lack of driving experience, while homeowners in flood-prone areas may see increased costs due to higher risk. Additionally, insurance companies utilize various algorithms and data sets to assess risk, which can lead to significant fluctuations in premium costs across different providers.

Knowing how to save on insurance premiums can help you keep your finances in check without sacrificing necessary coverage. Here are some effective strategies to consider:

- Shop around: Comparing quotes from multiple insurers can lead to better rates.

- Increase deductibles: Opting for higher deductible plans may result in lower monthly payments.

- Bundle policies: Purchasing multiple types of insurance from the same provider often qualifies you for discounts.

- Maintain a good credit score: Insurers frequently use credit ratings to determine premiums, so being financially responsible can pay off.

Choosing the Right Coverage: Key Questions to Ask Your Agent

When it comes to choosing the right coverage, asking the right questions can make all the difference in ensuring you have the protection you need. Start by inquiring about the types of coverage available:

- What are the main types of insurance policies suited for my needs?

- How do different coverage options protect me in various scenarios?

- Are there any exclusions or limitations I should be aware of?

Additionally, it’s crucial to understand the costs associated with your policy. Consider asking:

- What factors influence my premium rates?

- Are there any discounts available for bundling policies or maintaining a good claims history?

- How will my coverage needs change over time, and how can I adjust my policy accordingly?

By asking these key questions, you empower yourself to make informed decisions about your insurance coverage.