Tube Rank: Your Guide to Video Success

Discover tips and insights for optimizing your video presence.

Insurance Policies: The Unseen Safety Net You Didn't Know You Needed

Discover how insurance policies can be your ultimate safety net! Uncover the protection you might be missing and secure your peace of mind today.

Understanding the Basics: What Insurance Policies Cover and Why They Matter

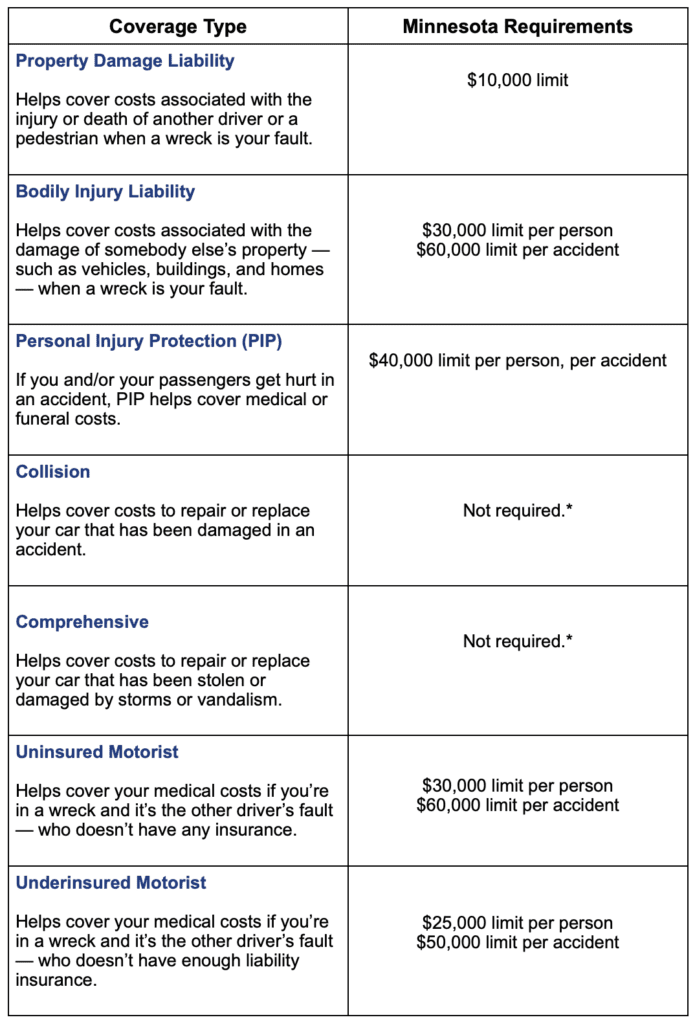

Understanding the basics of insurance policies is essential for protecting your assets and ensuring peace of mind. Insurance policies are contracts between the insurer and the insured, outlining the coverage provided against various risks. Common types of insurance policies include health, auto, home, and life insurance. Each policy has specific terms, conditions, and exclusions, which can significantly impact the level of protection offered. By familiarizing yourself with these policies, you empower yourself to make informed decisions regarding which coverage you need.

Insurance policies matter because they offer financial security in times of unexpected events. Without adequate coverage, individuals and businesses could face significant losses that may jeopardize their stability. For instance, health insurance can alleviate the burden of costly medical expenses, while auto insurance protects against liabilities resulting from vehicular accidents. Understanding what these policies cover, including key elements such as deductibles, premiums, and limits, is crucial for maximizing your protection and ensuring that you are adequately covered when it matters most.

Top 5 Life Events That Highlight the Importance of Having Insurance Coverage

Life is full of unpredictable moments, and having insurance coverage can provide vital financial protection during challenging times. Whether it’s celebrating jubilant milestones or facing unforeseen hardships, certain life events underscore the necessity of being well-insured. The following are the top five life events that remind us of the importance of securing our lives against financial burdens:

- Birth of a Child: Welcoming a new baby into the family is one of the most joyous occasions, but it also comes with significant responsibilities. Medical expenses and future educational costs make insurance coverage essential for ensuring your child’s well-being.

- Buying a Home: Purchasing a home is a major financial commitment that often requires homeowners insurance to protect against damage or loss. This coverage not only safeguards your investment but also offers peace of mind.

- Starting a Business: Entrepreneurs face various risks, making business insurance crucial for protecting assets and liabilities. This safety net allows business owners to focus on growth without the fear of unforeseen setbacks.

- Health Crisis: Illness or injury can strike anyone at any time. Health insurance is critical to managing medical expenses and ensuring access to necessary care without financial hardship.

- Retirement: Planning for retirement involves protecting your savings and ensuring your financial stability in your later years. Life insurance can play a key role in providing security for your loved ones after you’re gone.

Are You Truly Protected? Common Myths About Insurance Policies Debunked

When it comes to insurance, many people hold onto myths that can lead to significant misunderstandings about their coverage. One of the most common myths is that all insurance products are the same; however, this couldn't be further from the truth. Different policies serve distinct purposes. For example, health insurance covers medical expenses, while auto insurance protects against vehicle-related incidents. Not understanding these differences can leave you vulnerable and financially unprepared. It's essential to thoroughly research and comprehend the type of insurance you need based on your individual circumstances.

Another prevalent myth is that having insurance means that you are entirely protected from all risks. In reality, many policies come with exclusions and limits that can catch policyholders off guard. For instance, homeowners insurance typically does not cover damage from natural disasters like floods or earthquakes unless additional coverage is purchased. It is crucial to read the fine print and be aware of what your policy includes and excludes. Taking the time to educate yourself about these common myths will help ensure that you have adequate protection and peace of mind.