Tube Rank: Your Guide to Video Success

Discover tips and insights for optimizing your video presence.

Protecting Your Dreams: Why Business Insurance is a No-Brainer

Secure your future and protect your dreams! Discover why business insurance is an essential investment for every entrepreneur.

Top 5 Reasons You Can’t Afford to Skip Business Insurance

Business insurance is a crucial safety net for any enterprise, regardless of size or industry. One of the key reasons you can't afford to skip it is the financial protection it offers against unexpected events. Consider the fallout from events such as natural disasters, theft, or liability claims. Without insurance, the cost of recovery can be devastating and may even lead to business closure. In fact, studies show that nearly 70% of businesses that experience a major disaster without insurance never reopen. Ensuring that you have a suitable policy in place is essential for long-term sustainability.

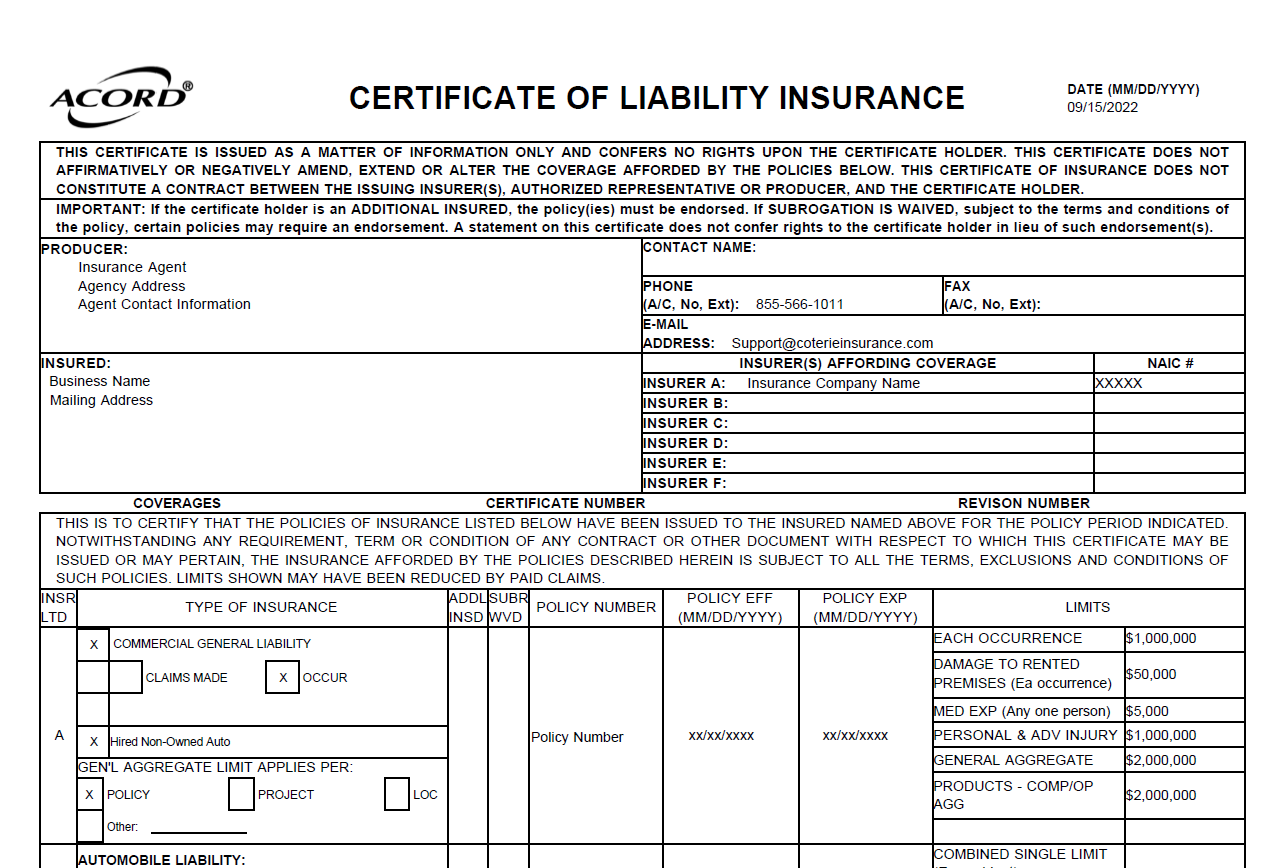

Moreover, business insurance enhances your company's credibility with clients and partners. When you demonstrate that your business is insured, you convey professionalism and responsibility, which can lead to increased trust and potentially more clients. This can give you a competitive advantage in your industry. Additionally, many clients now require proof of insurance before entering contracts, meaning that without it, you could be missing out on valuable opportunities. In short, business insurance is not just a safeguard; it's a strategic asset that contributes to your business's growth and success.

Understanding Different Types of Business Insurance: What You Need

When it comes to safeguarding your business, understanding the different types of business insurance is crucial. Each type of insurance offers unique protection against specific risks that companies may face. For instance, general liability insurance shields your business from claims related to bodily injury, property damage, and personal injury. Meanwhile, professional liability insurance, also known as errors and omissions insurance, protects service-based businesses from claims of negligence or inadequate performance. Being well-informed about these options empowers you to make educated decisions that align with your business needs.

Beyond general and professional liability, consider other essential coverages such as property insurance, which protects your business premises and assets from damage or loss due to events like theft, fire, or natural disasters. Likewise, workers' compensation insurance is mandatory in many states and covers employees who may suffer work-related injuries or illnesses. Additionally, if your business relies heavily on vehicles, commercial auto insurance is necessary to cover accidents and damages associated with business use. Evaluating these different types of business insurance will help you create a comprehensive risk management strategy that protects your company's livelihood.

Is Your Business Protected? Common Myths About Business Insurance

When it comes to business insurance, many entrepreneurs fall victim to common myths that can jeopardize their financial protection. One prevalent myth is that only large companies need insurance. In reality, businesses of all sizes face risks that can lead to substantial financial losses. Small businesses, in particular, are often unprepared for unforeseen events such as natural disasters or lawsuits, which can be devastating. Having adequate protection in place ensures that your business can weather these storms without collapsing under financial pressure.

Another misconception is that all types of business insurance are the same. In truth, there are several different types of coverage tailored to protect against specific risks. For example, general liability insurance covers third-party bodily injury and property damage, while professional liability insurance protects against claims of negligence in professional services. Understanding the distinct types of coverage available is essential in crafting a comprehensive insurance plan that meets your unique business needs. Don’t let these myths leave your company exposed—investigate your options thoroughly.