Tube Rank: Your Guide to Video Success

Discover tips and insights for optimizing your video presence.

Banking Without Borders

Discover how to break free from traditional banking limits. Explore global finance trends that empower your financial journey today!

Understanding Cross-Border Banking: A Comprehensive Guide

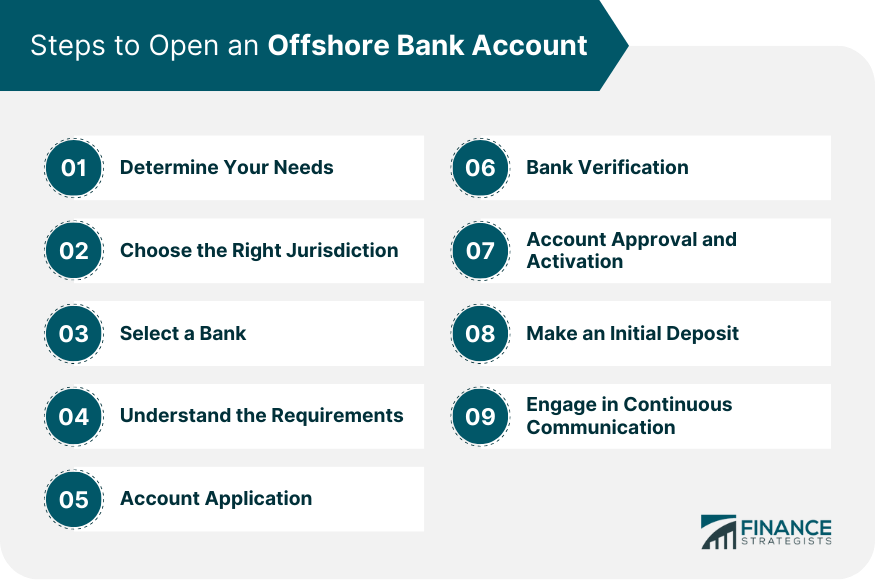

Understanding Cross-Border Banking involves delving into a complex ecosystem designed to facilitate financial transactions across international borders. This sector is crucial for individuals and businesses engaged in global trade, investments, or expatriate banking needs. Cross-border banking enables clients to access foreign financial institutions, which can offer various benefits such as diversified investment opportunities, access to international financial markets, and potentially favorable interest rates. However, it also comes with challenges such as regulatory compliance, currency risks, and the intricacies of different banking systems.

There are several key aspects to consider when navigating the world of cross-border banking:

- Currency Exchange: Fluctuations in exchange rates can impact the value of your funds.

- Tax Implications: Different countries have varying tax regulations, which can affect your returns.

- Regulatory Challenges: Understanding the legal requirements in both your home country and the foreign jurisdiction is vital.

The Future of Global Banking: Trends and Innovations Without Borders

The future of global banking is being reshaped by several significant trends and innovations that transcend national boundaries. As digital transformation accelerates, leading financial institutions are adopting blockchain technology to improve transparency and efficiency in cross-border transactions. This decentralized ledger not only enhances security but also reduces the costs associated with traditional banking processes. Furthermore, the rise of fintech companies is challenging established banks to innovate, as consumers increasingly prefer mobile banking solutions that offer convenience and speed. With the advent of artificial intelligence, banks are also leveraging data analytics to offer personalized services, enabling them to better understand customer needs and preferences.

Another key aspect of the future of global banking is the ongoing push towards regulatory harmonization across different jurisdictions. As more people engage in international banking, the demand for compliant and transparent solutions will rise. Initiatives like the Open Banking Regulation are paving the way for data sharing among banks and third-party providers, fostering innovation and competitive pricing. Additionally, sustainability and ethical financing are becoming important pillars of banking strategies, as both consumers and investors seek out institutions that prioritize green initiatives and social responsibility. In this evolving landscape, banks must embrace collaboration without borders to thrive in a rapidly changing environment.

What You Need to Know About Currency Conversion in International Transactions

When engaging in international transactions, understanding the nuances of currency conversion is crucial. Currency conversion refers to the process of exchanging one currency for another, which can significantly affect the overall cost of your transactions. With fluctuating exchange rates influenced by various factors such as economic conditions, political stability, and market demand, it is essential to stay informed. Moreover, different service providers may offer varying exchange rates along with additional fees, making it imperative to shop around for the best deal.

There are several key factors to consider when managing currency conversion in international transactions:

- Exchange Rates: Familiarize yourself with both the current and historical rates, as these can impact transaction costs over time.

- Fees and Charges: Always inquire about additional fees imposed by banks or online platforms, as these can add up unexpectedly.

- Conversion Methods: Understand the difference between spot transactions and forward contracts to decide which method suits your needs best.

By taking these elements into account, you can optimize the financial aspect of your international dealings.