Tube Rank: Your Guide to Video Success

Discover tips and insights for optimizing your video presence.

Don’t Get Caught Naked: The Dangers of Inadequate Insurance Coverage

Protect yourself from financial surprises! Discover the hidden risks of inadequate insurance coverage and how to safeguard your future.

Understanding the Hidden Risks: Why Inadequate Insurance Can Leave You Vulnerable

Understanding the hidden risks associated with inadequate insurance is crucial for anyone looking to protect their assets and financial future. Many individuals believe that simply having a basic insurance policy is sufficient, but this can often lead to unforeseen vulnerabilities. When accidents occur, such as natural disasters, accidents, or health emergencies, individuals relying on minimal coverage can face devastating expenses that may cripple their finances. It's vital to evaluate your needs and consider the potential gaps in coverage that can leave you exposed to significant out-of-pocket costs.

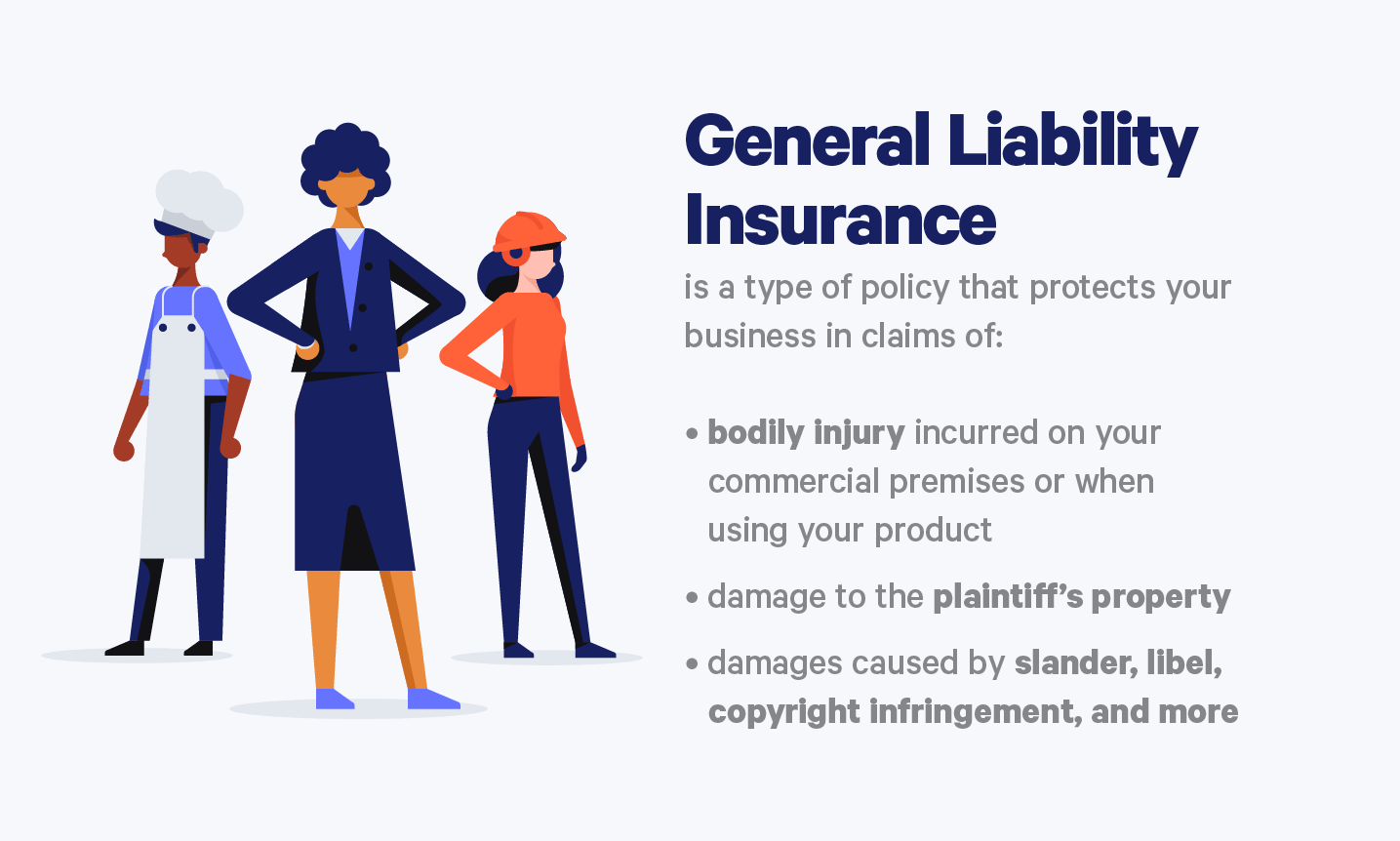

Inadequate insurance not only affects your personal finances but can also expose you to legal liabilities. For instance, if someone is injured on your property and you lack proper liability coverage, you could be personally responsible for their medical expenses and any legal fees incurred. This situation highlights the importance of assessing your insurance policies periodically and ensuring they align with your current circumstances. By understanding these hidden risks and taking proactive measures, you can avoid the pitfalls of inadequate insurance and enjoy greater peace of mind.

Is Your Insurance Coverage Enough? Common Gaps That Could Cost You

When evaluating your insurance coverage, it’s crucial to understand that not all policies are created equal. Many individuals believe they are adequately covered, only to discover common gaps in their policies that could lead to significant financial strain. Common gaps can include insufficient coverage limits, lack of endorsements for specific liabilities, or even missing essential riders that provide additional protection. For instance, homeowners insurance might not cover damage from natural disasters in certain areas, leaving policyholders vulnerable to hefty losses if a disaster strikes.

Another frequent pitfall is the misunderstanding of personal property coverage. Many policies may not fully account for high-value items like jewelry, art, or electronics, which could be severely underinsured. Additionally, some individuals overlook the importance of liability coverage, which protects against lawsuits for injuries that occur on their property. To ensure comprehensive protection, take the time to review your policy thoroughly and consult with an insurance expert. They can help identify any coverage gaps and suggest necessary adjustments to safeguard your financial future.

5 Essential Questions to Evaluate Your Insurance Coverage Effectively

Evaluating your insurance coverage is crucial to ensure that you are adequately protected against unforeseen circumstances. To start with, ask yourself: What types of coverage do I currently have? It’s essential to create a comprehensive list of all your active policies, including auto, home, health, and life insurance. This inventory will give you a clear picture of your existing coverage and help identify any gaps. Additionally, consider whether your coverage aligns with your current needs and life situation. For instance, if you've recently purchased a new home or car, you may need to adjust your policies accordingly.

Another key question is: Are my coverage limits sufficient? Many people overlook the importance of reviewing and potentially increasing their coverage limits. Life circumstances change, and so do the value of your assets. Regularly reassessing your limits can help prevent underinsurance during times of loss. Additionally, inquire about the deductibles associated with your policies. A higher deductible might lower your premiums, but it could also place a financial burden on you in the event of a claim. Taking the time to evaluate these factors will ensure that your insurance coverage meets your needs effectively.