Tube Rank: Your Guide to Video Success

Discover tips and insights for optimizing your video presence.

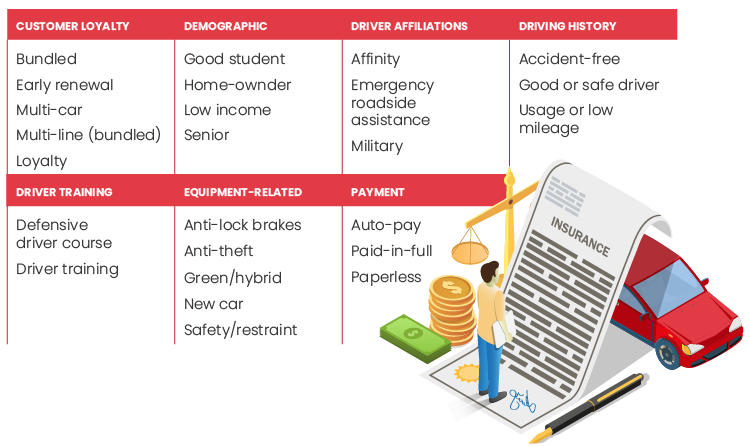

Discounts That Drive Down Your Premiums

Unlock hidden savings with discounts that can slash your premiums! Discover how to keep more cash in your pocket today!

Unlocking the Secrets of Discounts: How to Lower Your Insurance Premiums

Unlocking the secrets of discounts in your insurance policy can lead to significant savings on your premiums. Many insurance providers offer a variety of discounts, ranging from good driver incentives to bundling discounts for multiple policies. By understanding the different types of discounts available, you can strategically select the best options that apply to your situation. For instance, if you have a clean driving record, you may qualify for a safe driver discount. Similarly, combining your home and auto insurance with the same provider can often yield substantial savings.

Another effective strategy for lowering your insurance premiums is to regularly review your policy and make adjustments as necessary. Insurance companies frequently update their pricing structures and discounts, so it's essential to stay informed. Consider reaching out to your agent annually to discuss your coverage and explore potential discounts that may have become available since your last review. Additionally, consider increasing your deductible—a higher deductible typically results in lower monthly premiums, though it's crucial to ensure you can afford the out-of-pocket cost in the event of a claim.

Maximize Your Savings: Essential Discounts on Insurance You Might Not Know About

When it comes to managing your finances, one of the best ways to maximize your savings is by taking advantage of essential discounts on insurance that you may not be aware of. Many insurance companies offer a variety of discounts to help customers save money, including but not limited to multi-policy discounts, safe driver discounts, and bundling discounts. For instance, if you have both auto and home insurance with the same provider, you could save a significant percentage on your premiums.

Additionally, some providers offer discounts for certain professional affiliations or memberships. For example, being a member of specific organizations, such as alumni associations, military groups, or professional societies, can qualify you for lower rates. It’s also worth checking if you can receive a discount for having modern safety features in your vehicle or for being claims-free for a specified period. By actively seeking out these essential discounts, you can substantially cut down on your insurance costs and maximize your savings.

Are You Missing Out? Discover the Top Discounts That Could Slash Your Premiums

In today's competitive market, many consumers are unaware of the range of discounts available that could significantly reduce their premiums. Are you missing out? From bundling policies to utilizing loyalty programs, there are multiple ways to save. Here's a quick list of discounts you should consider:

- Bundled Policies: Combining home and auto insurance often leads to substantial savings.

- Safe Driver Discounts: Maintaining a clean driving record can earn you financial perks.

- Good Student Discounts: Students with high GPAs may qualify for lowered rates.

- Membership Discounts: Affiliations with certain organizations can provide exclusive savings.

Taking the time to explore all available options can make a significant difference in your insurance costs. Not only can these discounts help slash your premiums, but they also encourage you to reassess your coverage to ensure you are getting the best value for your money. Remember to shop around and compare quotes from different providers to maximize your potential savings.

"A little research can go a long way in uncovering hidden discounts!"