Tube Rank: Your Guide to Video Success

Discover tips and insights for optimizing your video presence.

Insurance Discounts You Didn't Know You Needed

Unlock hidden insurance discounts you never knew existed! Save big on premiums with these insider tips. Discover them now!

Unlock Hidden Savings: 5 Insurance Discounts You Didn't Know Existed

Finding ways to save on insurance can often feel like a daunting task. However, there are hidden discounts that many consumers are unaware of, which can lead to significant savings on premiums. For instance, many insurance companies offer discounts for bundling policies, such as combining auto and home insurance. Not only does this simplify your payments, but it can also lead to discounts of up to 25%. Additionally, being a part of certain organizations or professional groups can unlock exclusive insurance discounts that are not widely advertised.

Another fantastic way to reduce your insurance costs is by taking advantage of loyalty discounts. Many insurers reward long-term customers with lower premiums. Furthermore, don't overlook the potential savings tied to your credit score; a better score can often lead to lower rates. Lastly, if you have taken defensive driving courses, you may be eligible for a discount from your auto insurer, as it demonstrates your commitment to safe driving. By exploring these lesser-known options, you can effectively unlock hidden savings and lower your overall insurance costs.

Are You Missing Out? Discover These Lesser-Known Insurance Discounts

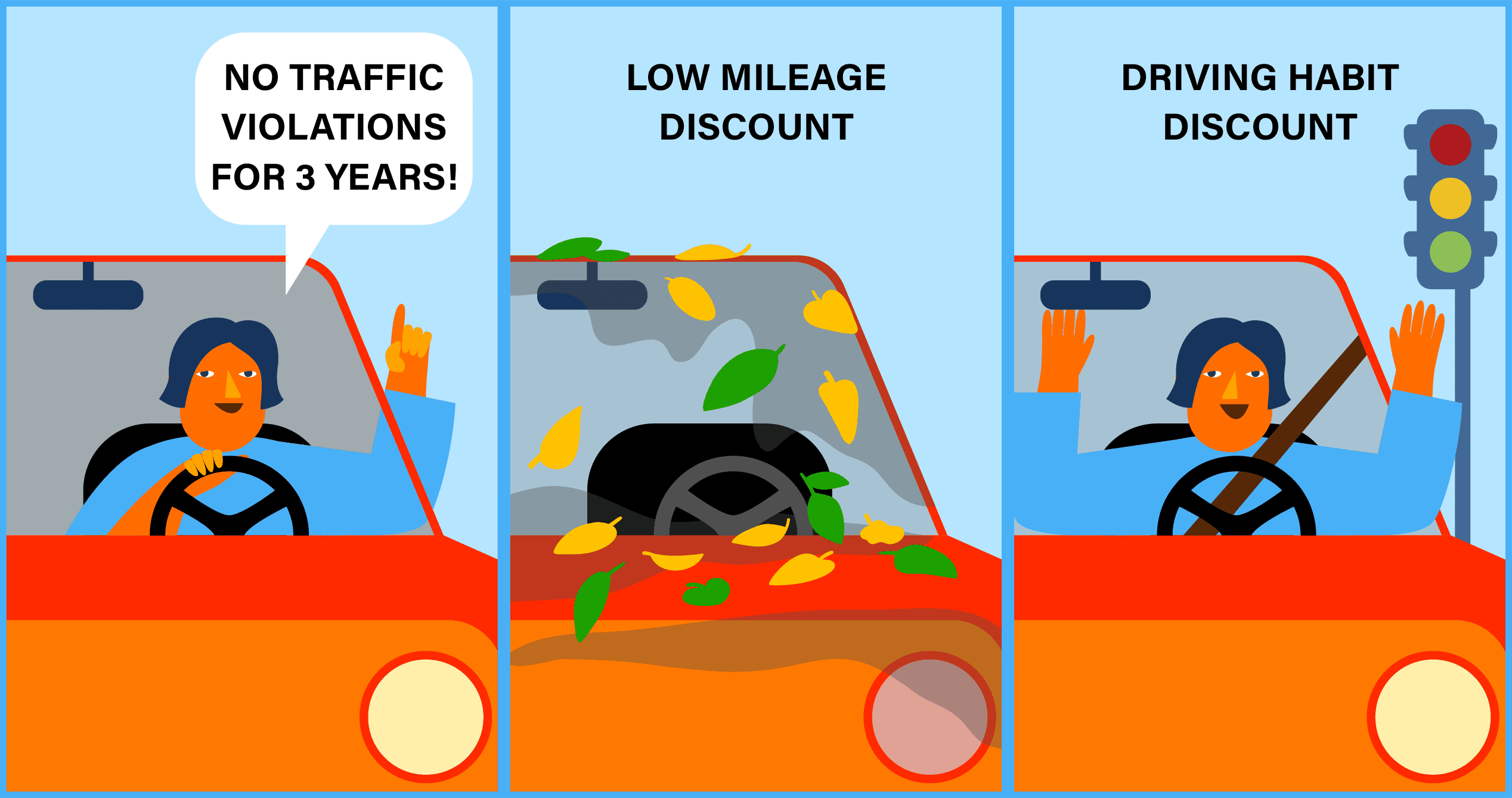

Many individuals are unaware of the various insurance discounts available to them, potentially resulting in higher premiums than necessary. From bundling policies to safe driving rewards, these lesser-known options can significantly reduce costs. For example, did you know that some insurers offer discounts for maintaining a good credit score or for taking defensive driving courses? It's crucial to communicate with your provider and ask about any specific discounts you might qualify for.

Additionally, certain organizations and affiliations can open doors to exclusive discounts. Members of professional associations, alumni groups, or even certain employers can access lower rates on their insurance policies. Here are some popular discounts you might be missing out on:

- Anti-theft device discounts for vehicles equipped with enhanced security.

- Low mileage discounts for those who drive less than average.

- Homeowner discounts for those who insure both their home and vehicle with the same company.

Maximize Your Coverage: Essential Insurance Discounts to Ask About

When it comes to managing your insurance expenses, asking about essential insurance discounts can significantly reduce your premium costs without sacrificing coverage. Many insurance providers offer a variety of discounts that you might not be aware of. For instance, multi-policy discounts reward you for bundling different types of insurance, such as auto and home. Additionally, inquire about safe driver discounts if you have a good driving record, as well as loyalty discounts for long-term customers. Understanding these options can help you maximize your coverage while keeping your budget intact.

Moreover, don't overlook discounts for specific qualifications or memberships. For example, some insurers provide student discounts if you or your children maintain good grades, while military discounts are often available for active service members and veterans. It's also worth asking about discounts for various safety features in your home or vehicle, such as security systems or anti-theft devices. By actively seeking out these essential insurance discounts, you not only enhance your financial wellbeing but also ensure that you are adequately protected against unforeseen circumstances.