Tube Rank: Your Guide to Video Success

Discover tips and insights for optimizing your video presence.

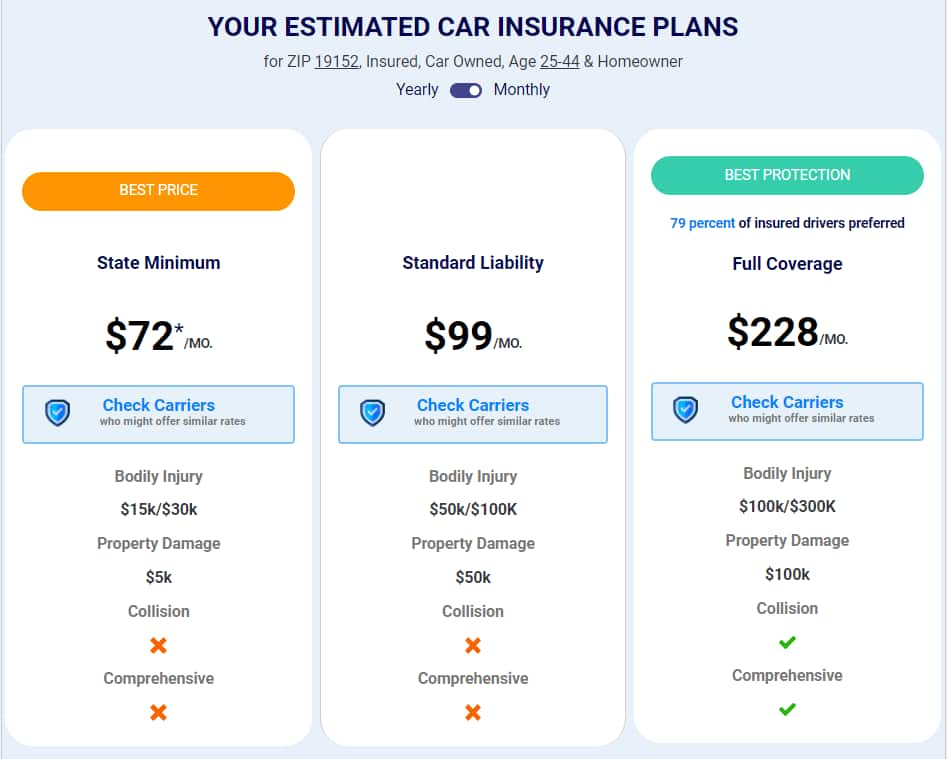

Insurance on a Budget: Finding Gold in the Cheap

Discover how to score affordable insurance without sacrificing coverage. Unlock savings and find gold in budget-friendly options!

Maximizing Coverage: How to Get the Most Value from Budget Insurance

When it comes to budget insurance, maximizing coverage is essential to ensure you get the most value from your investment. Start by thoroughly reviewing the policy details to understand what is covered and what isn’t. Look for options that allow you to customize your coverage, tailoring it to your specific needs. For instance, consider the basic components like liability coverage, property damage, and personal injury protection. Additionally, don’t overlook available discounts for bundling policies, maintaining a claims-free history, or participating in safe-driver programs.

Another crucial step in optimizing your budget insurance policy is to assess your needs regularly. As life circumstances change—whether you relocate, acquire new assets, or experience changes in health—your coverage should adapt accordingly. Utilizing tools like insurance comparison websites can help you evaluate different policies and ensure you're not overpaying for coverage that doesn’t meet your needs. Furthermore, maintaining open communication with your insurance agent can lead to discovering additional discounts or adjustments that can enhance your coverage without significantly increasing your premiums.

Hidden Gems: The Benefits of Low-Cost Insurance Plans

When it comes to protecting your assets, low-cost insurance plans often go unnoticed, overshadowed by mainstream providers with high premiums. However, these hidden gems can offer significant benefits, including affordability without sacrificing essential coverage. By opting for a budget-friendly insurance policy, individuals and families can allocate their savings toward other crucial expenses, making financial management smoother and less stressful.

Moreover, many low-cost insurance plans provide tailored coverage options that cater to specific needs. Policyholders can often find plans that address unique circumstances, whether it’s an affordable auto insurance option for young drivers or specialized health insurance for freelancers. This customization not only enhances satisfaction but also ensures that customers pay only for the protection they genuinely require, maximizing their investment.

Is Cheap Insurance Worth It? A Comprehensive Guide to Affordable Coverage

When considering cheap insurance, it's important to evaluate what you are sacrificing for lower premiums. While affordable coverage can help you save money in the short term, it may come with limitations such as high deductibles, lower coverage limits, or reduced customer service. This can leave you vulnerable in critical situations. To make an informed decision, assess your needs and weigh the potential risks against the savings you expect. Here are some key factors to consider:

- The extent of coverage provided

- Associated deductibles and out-of-pocket costs

- Exclusions and limitations in the policy

Ultimately, the question of whether cheap insurance is worth it depends on your individual circumstances and financial situation. If you are looking for budget-friendly options, it might be a good choice as long as you carefully read the policy details. Additionally, consider shopping around and comparing quotes from different providers to find the best balance between affordability and adequate coverage. Remember, the cheapest option may not always be the best choice if it doesn't adequately protect you when it matters most.