Tube Rank: Your Guide to Video Success

Discover tips and insights for optimizing your video presence.

Insurance Roulette: Are You Betting on Your Health?

Is your health a gamble? Discover the risks of inadequate insurance and learn how to protect your well-being in Insurance Roulette!

The Risks of Skipping Health Insurance: Are You Playing with Fire?

In today's unpredictable world, skipping health insurance can feel like a gamble with your financial well-being. Remember, medical emergencies often arise without warning, and the costs associated with them can be staggering. For instance, a simple trip to the emergency room can set you back several thousand dollars. According to a report by the National Institutes of Health, more than 60% of bankruptcies in the U.S. are tied to medical expenses. By opting out of health coverage, individuals are essentially exposing themselves to significant financial risks that could destabilize their lives.

Moreover, it's not just about the monetary implications; skipping coverage can lead to detrimental health outcomes. Those without insurance might delay seeking medical care, which can worsen existing health issues or lead to new ones. Health insurance provides not only coverage for emergencies but also preventive services that promote overall well-being. As reiterated by the HealthCare.gov, preventive care such as screenings and vaccinations can detect issues early on when they are typically more treatable. In the end, choosing to forgo health insurance may not only be a play with fire financially but could also put your health at risk.

Understanding Health Insurance Terms: Don’t Let Confusion Cost You

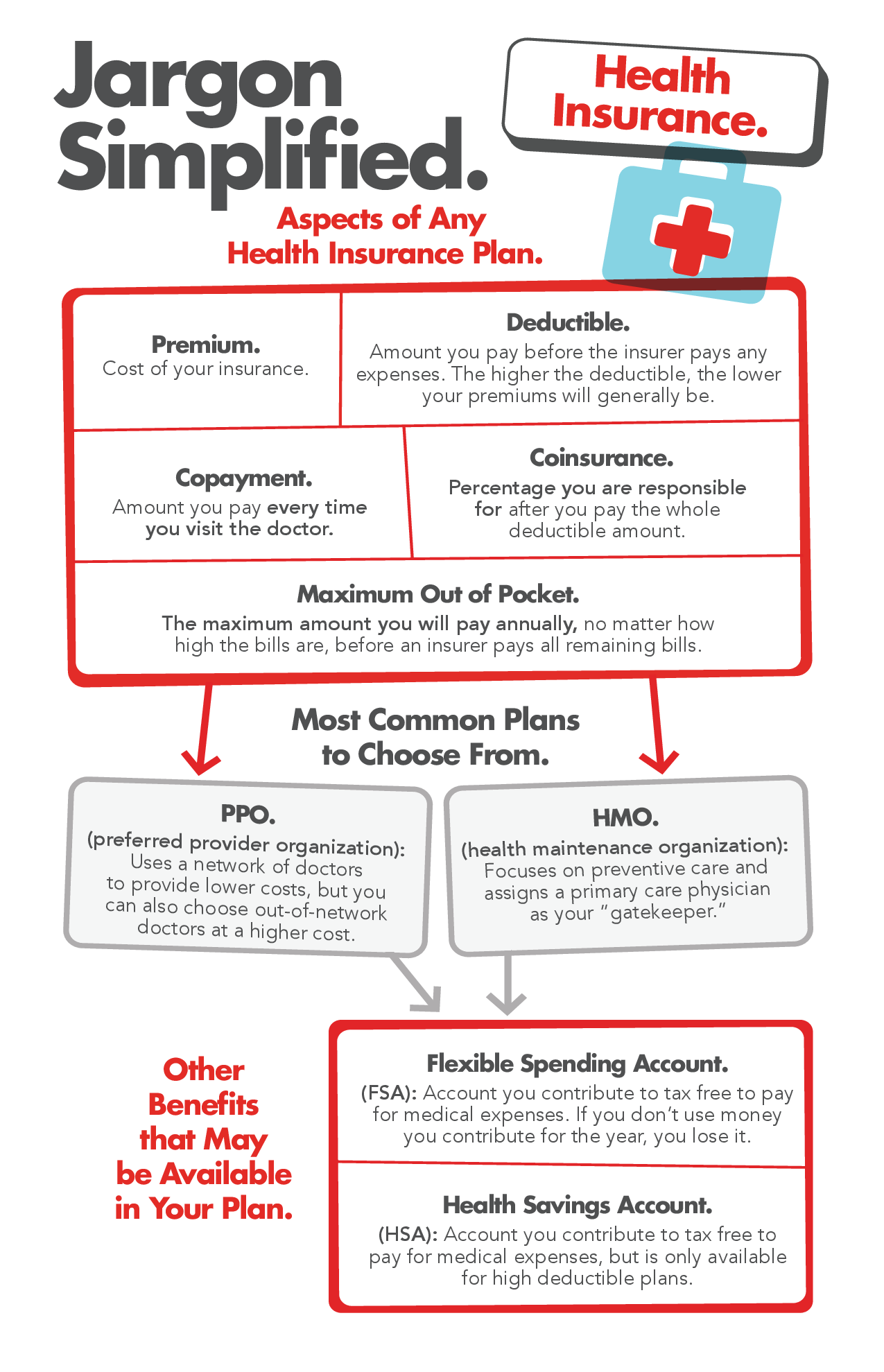

Understanding health insurance terms is crucial for making informed decisions about your coverage. Many people find themselves confused by jargon such as premium, deductible, and co-payment. A premium is the amount you pay for your insurance plan, usually on a monthly basis. The d deductible, on the other hand, is the amount you need to pay out-of-pocket before your insurance begins to cover costs. To gain a clearer understanding of these terms, you can visit Healthcare.gov's glossary, which provides detailed explanations.

Another key term is out-of-pocket maximum, the most you will have to pay for covered services in a plan year. Once you hit this limit, your insurance covers 100% of your essential health benefits. Additionally, knowing about network providers—doctors and hospitals that have contracts with your insurance to provide care at reduced rates—can save you money. For a deeper dive into why these terms matter, check out NCSL's overview.

How to Choose the Right Health Insurance Plan: Essential Questions to Ask

Choosing the right health insurance plan can seem overwhelming, but asking the right questions can simplify the process. Start by considering your healthcare needs, such as frequency of doctor visits and any ongoing treatments. Essential questions to ask include:

- What types of coverage does the plan offer?

- What is the premium cost, and how does it fit into your budget?

- Are your preferred doctors and hospitals included in the network?

Next, it’s important to evaluate the plan's out-of-pocket costs like copayments, deductibles, and coinsurance. These costs can vary significantly between plans. Ask yourself: How much will I pay for prescriptions? and Are preventive services covered at no extra cost? Understanding these factors ensures that you select a plan that not only meets your health needs but also aligns with your financial situation. For further guidance, check out NAHU's Health Insurance 101 for a more detailed breakdown.