Tube Rank: Your Guide to Video Success

Discover tips and insights for optimizing your video presence.

Investing Without a Safety Net: The Wild World of Stock Market Speculation

Dive into the thrilling world of stock market speculation! Discover daring strategies and tips for investing without a safety net.

Understanding Stock Market Speculation: Risks and Rewards

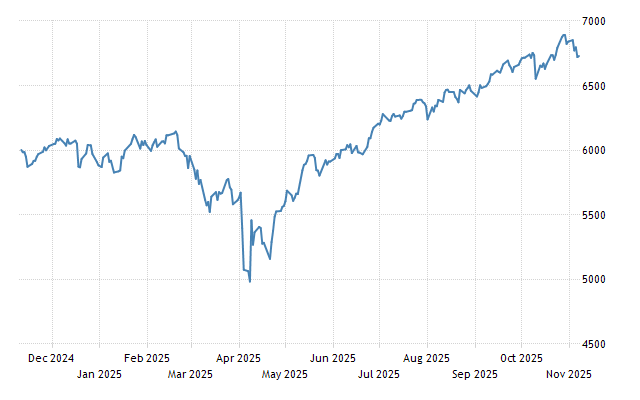

Understanding Stock Market Speculation involves navigating a landscape filled with both risks and rewards. At its core, speculation is the act of buying and selling assets, like stocks, with the expectation of making a profit based on predicted future price movements. While the potential for high returns can be enticing, it's crucial to recognize that speculation also carries a significant level of risk. Investors may experience volatility as market conditions fluctuate, leading to potential losses as well as gains. Knowing when to enter and exit positions, alongside setting realistic profit and loss targets, is vital for those looking to thrive in this competitive environment.

The key to successful speculation lies in understanding the underlying factors that influence stock prices. Market sentiment, economic indicators, and company performance can all play substantial roles in shaping investor behavior. Risk management strategies, such as diversification of investments and constant market analysis, are essential for mitigating losses. Furthermore, it's important for investors to remain disciplined, avoiding emotional decisions that can lead to hasty trades. By balancing the potential for profit against the inherent risks, investors can better position themselves to navigate the complex world of stock market speculation.

Is Stock Market Speculation Right for You? A Beginner's Guide

Entering the world of investing can be both exciting and intimidating, especially when considering stock market speculation. Is stock market speculation right for you? This question is crucial to answer before diving in, as speculation involves predicting future price movements based on market trends and economic indicators rather than the fundamentals of a company. For beginners, understanding the risks is essential; stock prices can be volatile, and while the potential for profit can be alluring, there is also a high chance of loss. Therefore, it is important to assess your own risk tolerance, investment goals, and time horizon before engaging in speculative trading.

To help you evaluate whether speculation fits your investing style, consider the following factors:

- Experience Level: Are you comfortable with the complexities of market analysis?

- Financial Stability: Can you afford to lose the money you invest?

- Investment Goals: Seeking quick gains or long-term growth?

Top 5 Strategies for Navigating the Wild World of Stock Speculation

Top 5 Strategies for Navigating the Wild World of Stock Speculation

Stock speculation can be a thrilling yet daunting endeavor, with the potential for both substantial gains and significant losses. To enhance your chances of success, understanding market trends is essential. Start by conducting thorough research on the companies you are interested in, focusing on their financial health, industry position, and news that might affect their performance. Additionally, employing technical analysis can help identify patterns and potential price movements. Remember, knowledge is power, and the more informed you are, the better equipped you'll be to navigate the wild world of stock speculation.

Moreover, developing a disciplined risk management strategy is crucial. Set clear entry and exit points for your trades, and never invest more than you can afford to lose. Diversifying your portfolio can also mitigate risk, allowing you to spread your investments across various sectors. Finally, emotional control plays a vital role in speculation; avoid making impulsive decisions based on fear or greed. By following these strategies, you can improve your odds in the unpredictable realm of stock speculation.