Tube Rank: Your Guide to Video Success

Discover tips and insights for optimizing your video presence.

Quote Me If You Can: The Sneaky Secrets Behind Insurance Pricing

Unlock the hidden secrets of insurance pricing! Discover how quotes are crafted and save big on your next policy. Dive in now!

Understanding the Factors That Drive Insurance Pricing

Understanding the factors that drive insurance pricing is essential for policyholders to make informed decisions. Several key elements influence how insurers calculate premiums, starting with risk assessment. Insurance companies analyze various factors, including age, health, driving record, and location, to determine the likelihood of a claim being made. This analysis helps them evaluate the potential cost of covering a policyholder, which in turn affects the pricing strategy.

Another significant factor is market conditions, such as competition and economic trends. Insurers must remain competitive within the market, adjusting their rates based on what others are offering. Additionally, external factors, like natural disasters or significant shifts in claim frequency, can lead to changes in insurance pricing. Policyholders should also be aware of demand fluctuations, as increased claims in a specific area may cause rates to rise, highlighting the dynamic nature of insurance pricing.

The Hidden Costs of Insurance: What You Need to Know

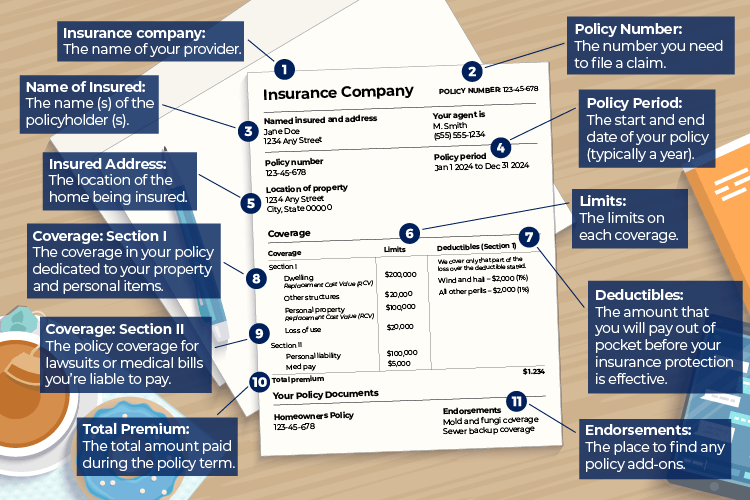

Insurance can provide essential protection against unforeseen events; however, there are often hidden costs that can catch policyholders off guard. These costs are not always apparent when signing up for a policy. For instance, many people overlook deductibles, which are the amounts you must pay out-of-pocket before your coverage kicks in. Additionally, some policies come with exclusions, meaning certain situations or damages are not covered, leaving you financially vulnerable. It's crucial to read the fine print and understand these terms to avoid unexpected expenses later.

Another factor contributing to the hidden costs of insurance is the potential for rising premiums. While many insurers advertise low initial rates, they may increase over time based on factors such as your claim history, location, and even changes in the market. Furthermore, the cost of optional add-ons—like additional coverage for specialized items—can accumulate quickly. To truly grasp the total cost of your insurance, it's vital to conduct a thorough review of both the initial fees and the long-term financial implications.

Why Did My Premium Go Up? Common Insurance Pricing Myths Debunked

If you've recently noticed an increase in your insurance premium, you're not alone. Many policyholders face this dilemma and often jump to conclusions based on common myths about insurance pricing. One prevalent belief is that insurers raise premiums solely to increase their profits. While profitability is a goal for any business, **insurance companies** base their pricing on a variety of factors, including claims history, changes in risk assessment, and even broader market trends. Understanding these factors can help demystify the reasoning behind premium adjustments.

Another widespread myth suggests that simply being a loyal customer guarantees lower premiums. While it's true that loyalty can lead to certain discounts, it does not shield you from the inevitability of **premium increases** based on changing underwriting criteria or external economic influences. For instance, if your neighborhood becomes a higher-risk area or if there are significant changes in the statistical data affecting your particular coverage, such adjustments can lead to an increase in your rates. It's important to stay informed and regularly review your policy details to understand the complete picture.