Tube Rank: Your Guide to Video Success

Discover tips and insights for optimizing your video presence.

Save Big on Your Ride: Surprising Auto Insurance Discounts You Didn't Know Existed

Unlock secret auto insurance discounts and save big on your ride! Discover surprising ways to drop your premiums today!

Unlock Hidden Savings: Top 10 Auto Insurance Discounts You May Overlook

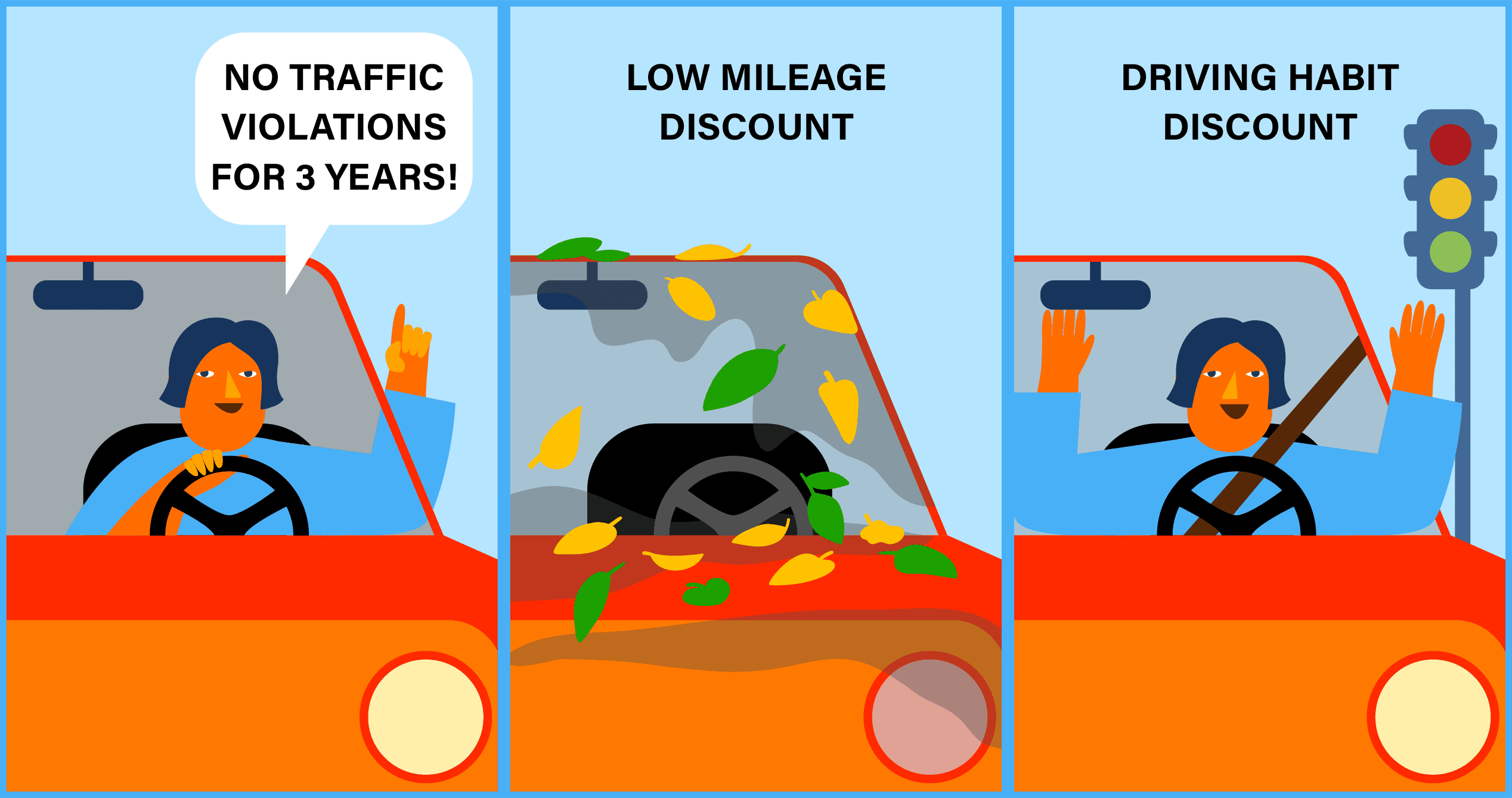

Finding the right auto insurance can often feel overwhelming, especially when it comes to understanding the various discounts available. Many drivers are unaware of the hidden savings that can significantly reduce their premiums. From safe driving records to bundling policies, here are the top 10 auto insurance discounts you may overlook:

- Safe Driver Discount: Maintain a clean driving record without accidents or traffic violations.

- Multi-Policy Discount: Bundle your auto insurance with home or renters insurance.

- Good Student Discount: Full-time students with good grades may qualify for discounts.

- Low Mileage Discount: Drive less than a certain number of miles per year.

- Military Discount: Active duty members and veterans often receive reduced rates.

- Anti-Theft Device Discount: Installing anti-theft devices can lead to savings.

- Defensive Driving Course: Completing a state-approved driving course can earn you a discount.

- Pay-in-Full Discount: Paying your premium in one lump sum may reduce your overall cost.

- New Car Discount: Some insurers offer discounts for new vehicles equipped with safety features.

- Affiliation Discount: Certain employer, alumni, or professional associations may qualify you for additional savings.

Are You Missing Out? Exploring Lesser-Known Auto Insurance Discounts

When it comes to auto insurance, many drivers are aware of the conventional discounts, such as those for safe driving records or bundling policies. However, there are numerous lesser-known auto insurance discounts that could significantly reduce your premium costs. For example, did you know that certain insurance companies offer discounts for vehicles equipped with advanced safety features? These could include features like automatic emergency braking, lane-keeping assist, or adaptive cruise control. By investing in such technology, not only are you enhancing your vehicle's safety, but you might also unlock substantial savings on your insurance.

Another frequently overlooked discount comes from your personal affiliations. Many drivers may qualify for auto insurance discounts based on their memberships in specific organizations or groups, such as alumni associations, military service, or professional affiliations. Additionally, some insurers provide discounts for completing defensive driving courses or maintaining good grades as a student. To take full advantage of these opportunities, it’s essential to communicate with your insurance agent and inquire about any potential discounts that you may be eligible for but have yet to explore.

Maximize Your Savings: How to Find and Take Advantage of Auto Insurance Discounts

Maximizing your savings on auto insurance starts with understanding the various discounts that are available to you. Many insurance providers offer a variety of incentives that can significantly lower your premium. Start by checking for common discounts such as:

- Good driver discounts for those with a clean driving record.

- Bundling discounts when you purchase multiple policies, like home and auto insurance, from the same company.

- Low mileage discounts if you drive fewer miles than the average driver.

- Student discounts, which are often available for young drivers who maintain good grades.

After identifying potential discounts, be proactive in taking advantage of them. It's essential to talk to your insurance agent about every possible savings opportunity. Additionally, consider reviewing your policy annually to ensure that you are still receiving all eligible discounts and to adjust your coverage as needed. Remember to shop around and compare quotes from different providers, as some companies may offer better rates or unique discounts that cater specifically to your needs. By staying informed and engaged, you can maximize your savings and keep your auto insurance costs low.