Tube Rank: Your Guide to Video Success

Discover tips and insights for optimizing your video presence.

Term Life Insurance: More Than Just a Safety Net

Discover how term life insurance can be a powerful tool for your financial future, not just a safety net. Uncover the benefits today!

Understanding Term Life Insurance: Key Benefits Beyond Financial Security

Term life insurance is often primarily recognized for its financial security, providing a safety net for your loved ones in the event of your untimely passing. However, there are several key benefits that extend beyond mere financial considerations. For instance, term life insurance policies are typically more affordable than permanent life insurance, allowing individuals and families to access significant coverage at a lower cost. This affordability means that you can invest the savings in other essential areas of your life, such as savings and investments, securing your family's future beyond just insurance protection.

Moreover, term life insurance is designed with simplicity in mind. It has a straightforward application process and clear terms, making it accessible for virtually anyone. Another critical advantage is the flexibility that comes with term policies. Individuals can select the duration of coverage based on their specific needs, whether it's to cover the duration of a mortgage or to provide for children until they become financially independent. This adaptability not only ensures that you have adequate protection but also offers peace of mind knowing that your family is safeguarded during critical times.

Term Life Insurance FAQs: What You Need to Know

Term life insurance is a popular choice for individuals seeking affordable coverage for a specified period. It provides a death benefit to your beneficiaries if you pass away during the term, which usually ranges from 10 to 30 years. Many people choose term life insurance to cover significant financial obligations, such as a mortgage or children's education, ensuring their loved ones are protected. Before purchasing a policy, it's essential to assess your needs, understand the different terms available, and consider the financial stability of the insurance provider.

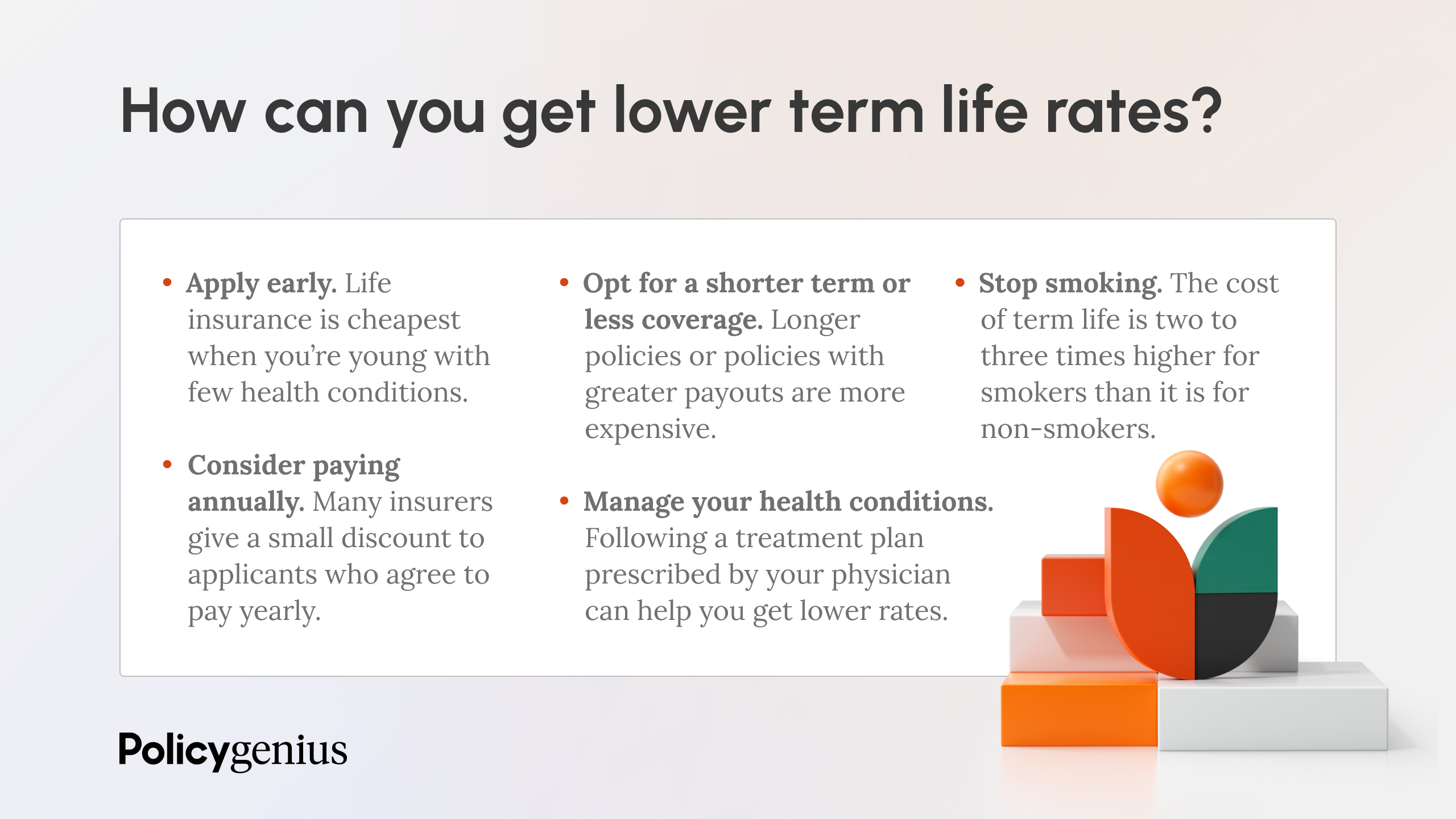

One of the most common questions about term life insurance is how premiums are determined. Factors such as your age, health status, and lifestyle choices play a crucial role in the calculation. Additionally, many policies offer the option to convert to a permanent life insurance policy later in life. Remember, the key to making an informed decision is to compare multiple policies and read the fine print. If you have further questions, consider reaching out to a licensed insurance agent who can provide tailored advice based on your unique situation.

The Role of Term Life Insurance in Financial Planning: A Comprehensive Guide

Term life insurance plays a crucial role in financial planning by providing a safety net for your loved ones in the event of an untimely passing. It is an affordable option, offering coverage for a specific term, usually ranging from 10 to 30 years. This type of insurance ensures that your dependents are financially secure, covering essential expenses such as mortgages, children's education, and daily living costs. By incorporating term life insurance into your overall financial strategy, you can effectively manage risks and safeguard your family's future, making it an indispensable component of any comprehensive financial plan.

In addition to its protective benefits, term life insurance can also serve as a strategic financial tool. It helps in mitigating debt and providing peace of mind during critical life events. For instance, a young family might choose a 20-year term policy to ensure that their children are provided for until they reach adulthood. When considering your options, assess factors such as your financial obligations, income, and long-term goals. This analysis allows you to determine the appropriate coverage amount and duration, ultimately enabling you to build a robust financial framework that prioritizes your family's security.