Tube Rank: Your Guide to Video Success

Discover tips and insights for optimizing your video presence.

Term Life Insurance: The Safety Net You Didn’t Know You Needed

Discover why term life insurance is the crucial safety net you never knew you needed. Protect your loved ones today!

Understanding Term Life Insurance: Key Benefits Explained

Term life insurance is a popular choice for individuals seeking affordable coverage for a specified period, typically 10, 20, or 30 years. One of the primary benefits of this type of insurance is its cost-effectiveness compared to whole life policies. Premiums are generally lower, allowing individuals to secure substantial coverage at a fraction of the cost. Additionally, term life insurance pays out a death benefit to designated beneficiaries if the policyholder passes away during the term, providing financial protection for loved ones during critical years like raising children or paying off a mortgage.

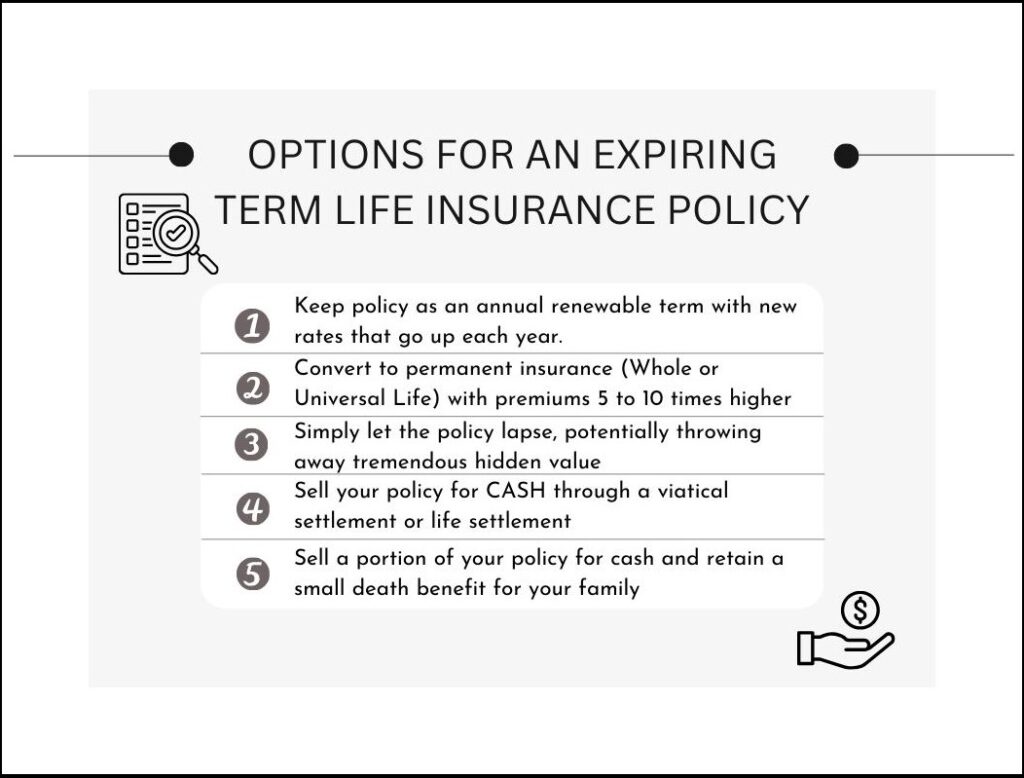

Another significant advantage of term life insurance is its simplicity and straightforward nature. Unlike permanent life insurance, which can involve complex investment components, term policies are easy to understand and manage. This simplicity makes it easier for policyholders to focus on their financial goals without getting bogged down by complicated terms. Furthermore, many term life insurance policies offer the option to convert to permanent coverage as policyholders' needs change over time, providing flexibility and peace of mind that can adapt as life evolves.

Is Term Life Insurance Right for You? 5 Essential Questions to Consider

Deciding whether term life insurance is right for you involves careful consideration of several key factors. First, reflect on your current financial obligations, such as mortgages, loans, or dependent care. Understanding your needs can help you determine the appropriate coverage amount. Additionally, consider the duration for which you need coverage; term life insurance is beneficial for a specified period, making it ideal for those looking to cover temporary financial responsibilities. It's essential to balance your premiums against potential family needs.

To further guide your decision, ask yourself these five essential questions:

- How many dependents rely on my income?

- What are my long-term financial goals?

- How much coverage do I need to meet those goals?

- What is my budget for insurance premiums?

- Am I comfortable with a policy that expires after a specific term?

How Term Life Insurance Provides Financial Security for Your Loved Ones

Term life insurance is a vital financial tool that offers peace of mind to individuals and families by ensuring that loved ones are financially protected in the event of an untimely death. By selecting a specific term, typically ranging from 10 to 30 years, policyholders can guarantee that their beneficiaries receive a death benefit that can cover essential expenses such as funeral costs, outstanding debts, and daily living expenses. This structured financial support acts as a safety net to help families navigate through challenging times, allowing them to focus on healing rather than worrying about monetary burdens.

Moreover, the affordability of term life insurance makes it an attractive option for many individuals seeking financial security. The premiums are generally lower than those associated with permanent life insurance policies, enabling a wider audience to benefit from this crucial coverage. As families grow and circumstances change, having a term life insurance policy can offer reassurance that, should the worst happen, their loved ones will be equipped to maintain their current lifestyle and fulfill future obligations without the stress of financial instability.