Tube Rank: Your Guide to Video Success

Discover tips and insights for optimizing your video presence.

Term Life Insurance: The Safety Net You Didn't Know You Needed

Discover the hidden benefits of term life insurance and why it could be the safety net you never knew you needed for your family's future!

Understanding the Basics of Term Life Insurance: Is It Right for You?

Term life insurance is a straightforward and affordable option designed to provide financial protection to your beneficiaries in the event of your untimely death. Unlike whole life insurance, which offers lifelong coverage and includes a cash value component, term life insurance covers you for a specified period, usually ranging from 10 to 30 years. This type of policy is particularly appealing for individuals looking to secure their family’s financial future during critical years, such as while raising children or paying off a mortgage. It's important to assess your current needs and future financial obligations to determine if term life insurance is the right fit for you.

Before committing to a term life insurance policy, consider the following factors:

- Coverage Amount: Evaluate how much coverage you need by calculating your debts, living expenses, and future obligations.

- Policy Length: Choose a policy length that aligns with your financial responsibilities, ensuring loved ones are protected during crucial periods.

- Health Considerations: Your health and lifestyle can significantly impact premiums, so be honest during the application process.

The Benefits of Term Life Insurance: Protecting Your Loved Ones

Term life insurance offers a simple and cost-effective way to ensure that your loved ones are financially protected in the event of your untimely death. Unlike permanent life insurance, term life policies provide coverage for a specified period, typically ranging from 10 to 30 years. This allows policyholders to choose a term that aligns with their financial responsibilities, such as paying off a mortgage or funding education for their children. By choosing term life insurance, you're not only investing in peace of mind but also ensuring that your family can maintain their standard of living even in your absence.

One of the most significant benefits of term life insurance is its affordability. Premiums for term policies are generally lower than those for whole life insurance, making it accessible for families on a budget. Additionally, many policies offer the option to convert to a permanent policy later on, providing flexibility as your financial situation evolves. In summary, term life insurance successfully combines affordability with vital protection, allowing you to secure your family's future without straining your current finances.

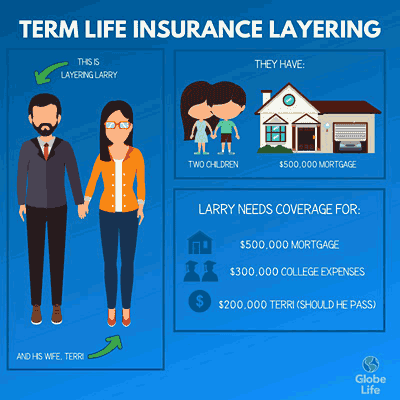

How Much Term Life Insurance Coverage Do You Really Need?

Determining how much term life insurance coverage you need can feel overwhelming, but it primarily hinges on your unique financial situation and obligations. A commonly used rule of thumb is to aim for coverage that is approximately 10 to 15 times your annual income. This formula helps ensure that your loved ones are adequately protected and can maintain their standard of living in your absence. Additionally, consider incorporating factors such as existing debts, future expenses like children's education, and any other financial responsibilities into your calculations.

Another effective way to calculate term life insurance coverage is to use the needs analysis method. This approach involves outlining your beneficiaries' financial needs and estimating how much money they would require during a specific period after your passing. Start by listing significant expenses like mortgage balances, outstanding debts, and anticipated costs for education. Subtract any assets that can be liquidated, such as savings or investments. This comprehensive assessment ensures you arrive at a coverage amount that truly reflects your family's needs, granting you peace of mind.