Tube Rank: Your Guide to Video Success

Discover tips and insights for optimizing your video presence.

Whole Life Insurance: The Eternal Nest Egg Everyone Ignores

Unlock the secrets of whole life insurance—discover why this overlooked financial tool could be your ultimate nest egg!

Understanding Whole Life Insurance: A Comprehensive Guide

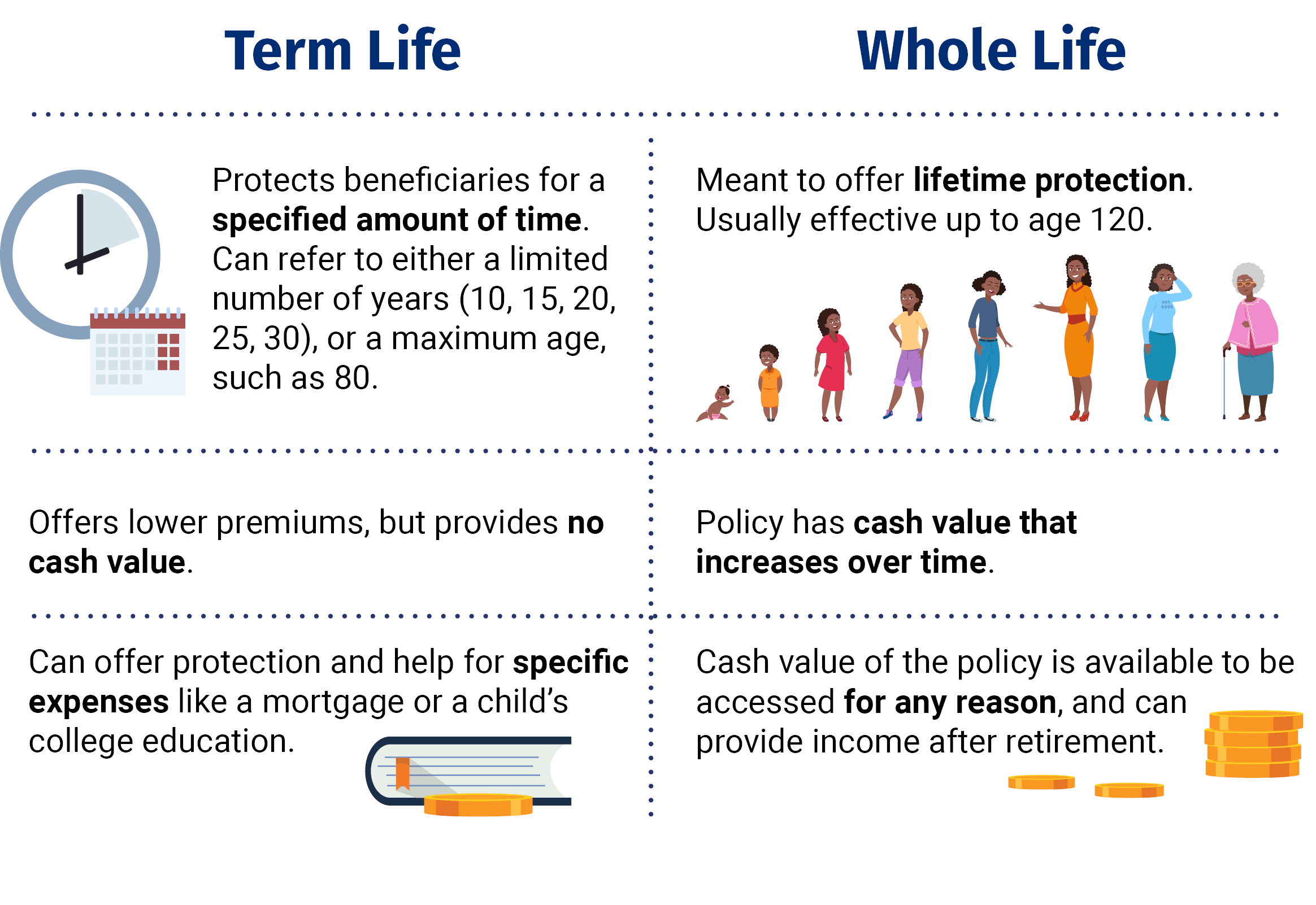

Whole life insurance is a type of permanent life insurance that provides coverage for the insured's entire lifetime, as long as the premiums are paid. Unlike term life insurance, which only offers coverage for a specified period, whole life insurance combines a death benefit with a savings component, known as cash value. This cash value grows at a guaranteed rate and can be accessed during the policyholder's lifetime, making it a valuable financial tool for various life stages. Understanding the unique features of whole life insurance can help individuals make informed decisions about their long-term financial planning.

When considering whole life insurance, it's important to evaluate its advantages and disadvantages. Some key benefits include:

- Lifetime coverage, ensuring your beneficiaries receive a death benefit regardless of when you pass away.

- Guaranteed cash value growth, which can serve as a financial resource for emergencies or investments.

- Potential dividends, depending on the insurance company, that can enhance the policy's value.

However, whole life insurance often comes with higher premiums compared to term policies, and it may not be the best fit for everyone. Therefore, assessing your financial situation and long-term goals is essential before committing to a whole life policy.

Is Whole Life Insurance the Best Investment for Your Future?

When considering whether whole life insurance is the best investment for your future, it's essential to understand its unique benefits. Whole life insurance provides not only a death benefit but also a cash value component that grows over time. This dual aspect allows policyholders to borrow against or withdraw from the cash value, making it a potentially valuable asset that can contribute to your long-term financial planning. Moreover, the premiums you pay are typically fixed, which means you can plan your budget without worrying about fluctuating costs.

However, it's important to weigh the pros and cons before making a decision. While whole life insurance can provide stability and security, it may not yield the same returns as other investment options, such as stocks or mutual funds. Additionally, the initial costs can be significantly higher compared to term life insurance, which might create a budget constraint for some individuals. Carefully evaluating your financial goals and consulting with a financial advisor can help determine if whole life insurance truly aligns with your investment strategy.

Top 5 Myths About Whole Life Insurance Debunked

When it comes to whole life insurance, misinformation can lead to poor financial decisions. One common myth is that whole life insurance is only for the wealthy. In reality, whole life policies can be tailored to fit various budgets, allowing individuals from different financial backgrounds to secure lifelong coverage. This flexibility enables policyholders not only to provide for their loved ones in the case of untimely death but also to build cash value over time, which can serve as an essential financial asset.

Another prevalent misconception is that whole life insurance is a terrible investment compared to other financial products. While it's true that some investment options may yield higher returns, whole life insurance offers unique benefits such as guaranteed death benefits and a predictable growth of cash value. This combination of features makes whole life an attractive option for risk-averse individuals. Moreover, the cash value can be accessed in emergencies, providing policyholders with a safety net that many traditional investments may not offer.