Tube Rank: Your Guide to Video Success

Discover tips and insights for optimizing your video presence.

Whole Life Insurance: The Unseen Superhero of Financial Planning

Discover why whole life insurance is the ultimate financial planning game-changer and how it could save your financial future!

What Makes Whole Life Insurance a Key Player in Your Financial Strategy?

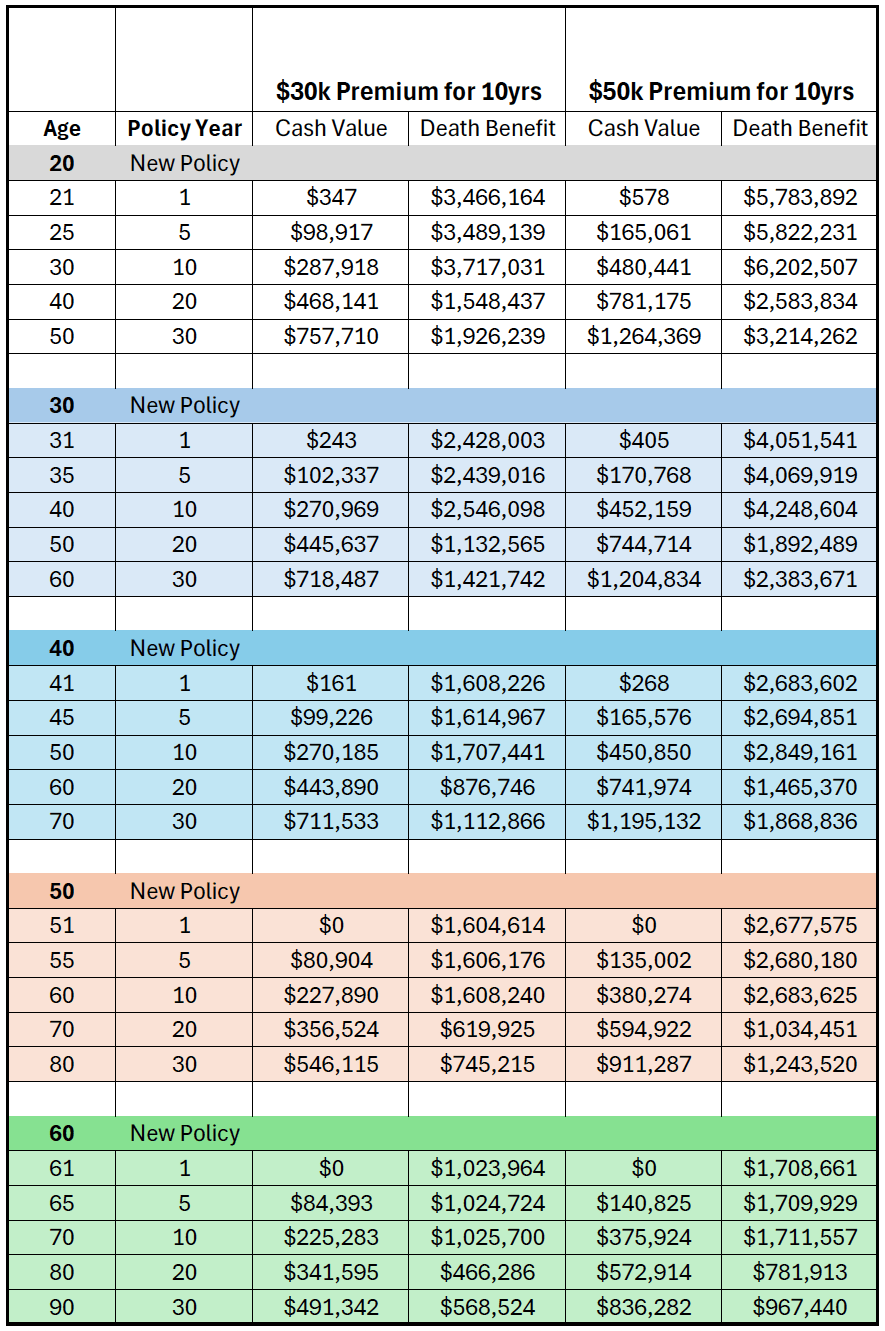

Whole life insurance serves as a fundamental component of a well-rounded financial strategy due to its unique blend of benefits. Unlike term life insurance, which provides coverage for a specific period, whole life insurance offers lifelong protection, ensuring that your loved ones are financially secure regardless of when you pass away. In addition to the death benefit, whole life policies also accumulate cash value over time—an essential aspect that can act as a savings vehicle. This cash value grows at a guaranteed rate and can be accessed through loans or withdrawals, giving policyholders a source of funds for emergencies or investment opportunities.

Furthermore, incorporating whole life insurance into your financial plan can provide significant tax advantages. The death benefit is typically income tax-free to your beneficiaries, ensuring that they receive the full amount without deductions. Additionally, the cash value that accumulates within the policy grows on a tax-deferred basis, meaning you won’t owe taxes on the gains as long as the money remains within the policy. By strategically leveraging these features, whole life insurance not only fortifies your financial security but also enhances your overall wealth-building strategy.

The Benefits of Whole Life Insurance: More Than Just a Safety Net

Whole life insurance is often viewed merely as a safety net for one's beneficiaries in the event of untimely death, but its benefits extend far beyond that. One of the most significant advantages is the cash value component. Unlike term life insurance, which offers coverage for a specified period, whole life policies accumulate cash value over time, allowing policyholders to borrow against this amount or even withdraw it if necessary. This feature provides a unique financial asset that can be used for emergencies, investments, or other significant expenses, making it an integral part of a comprehensive financial plan.

Moreover, owning a whole life insurance policy can offer peace of mind through the predictability of premiums and guaranteed death benefits. As long as premiums are paid, the policy will remain in force for the entirety of the policyholder’s life, thus ensuring that loved ones will receive a financial cushion when needed. Additionally, policyholders can benefit from tax advantages, as the cash value grows tax-deferred and the death benefit is typically tax-free for beneficiaries. This combination of stability, growth potential, and tax efficiency solidifies whole life insurance as more than just a safety net—it's a valuable investment in one’s financial future.

Is Whole Life Insurance the Right Choice for Your Long-Term Financial Goals?

When considering whole life insurance as a financial product, it’s essential to evaluate how it aligns with your long-term financial goals. Whole life insurance provides not only a death benefit to your beneficiaries but also a cash value component that grows over time. This cash value can be accessed during your lifetime, potentially serving as a source of savings or emergency funds. However, it's important to recognize that this growth is generally slower compared to other investment vehicles. Therefore, if your goals include rapid wealth accumulation or aggressive investment strategies, you might want to explore alternatives.

Moreover, whole life insurance policies can be quite expensive compared to term life insurance, and the premiums usually remain fixed throughout your life. For those seeking stability and a guaranteed return on their investment, whole life insurance may be suitable. However, individuals with tighter budgets or those just starting their financial journey may find that the cost outweighs the benefits. It's crucial to analyze your long-term financial goals, assess your current financial situation, and possibly consult a financial advisor to determine if whole life insurance is the right choice for you.