Tube Rank: Your Guide to Video Success

Discover tips and insights for optimizing your video presence.

Whole Life Insurance: The Policy That Keeps on Giving

Unlock financial peace of mind with whole life insurance—discover the benefits that last a lifetime and beyond!

Understanding Whole Life Insurance: Benefits and Features Explained

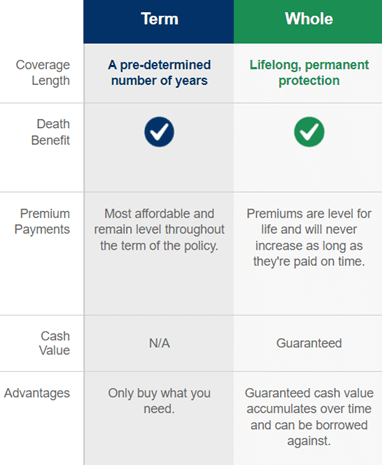

Understanding Whole Life Insurance is crucial for those looking for a stable and reliable financial planning tool. Whole life insurance is a type of permanent life insurance that provides lifetime coverage to the policyholder, as long as the premiums are paid. One of its primary features is the cash value component, which grows over time at a guaranteed rate. This means that not only is your loved one protected financially in the event of your passing, but you also have a savings vehicle that can be accessed during your lifetime. Benefits of whole life insurance include tax-deferred growth of the cash value, the ability to borrow against the policy, and fixed premiums that do not increase with age.

Moreover, whole life insurance also offers peace of mind as it guarantees a death benefit to your beneficiaries, which can be used to cover outstanding debts, funeral expenses, or as an inheritance. The policy can be tailored to your individual needs with options such as riders for additional coverage or benefits, further enhancing its versatility. Understanding the intricacies of whole life insurance, including its benefits such as guaranteed returns and lifetime coverage, can help individuals make informed decisions about their financial future and ensure that their loved ones are protected long after they are gone.

Is Whole Life Insurance Right for You? Key Questions to Consider

When considering whether Whole Life Insurance is right for you, it’s essential to reflect on your long-term financial goals. Ask yourself questions such as:

- What are my financial obligations and debts?

- Do I need a life insurance policy that builds cash value over time?

- Am I prepared for the higher premium costs associated with whole life insurance as opposed to term life insurance?

Another critical aspect to evaluate is your current and future needs. Consider:

- Do I have dependents who rely on my income?

- How does whole life insurance fit into my estate planning?

- Am I comfortable committing to a long-term financial product?

How Whole Life Insurance Provides Financial Security for Generations

Whole life insurance is not just a policy; it is a powerful tool for building financial security that can extend across generations. Unlike term insurance, which provides coverage for a limited period, whole life insurance offers lifelong protection and accumulates cash value over time. This cash value can serve as a financial resource for policyholders, allowing them to access funds for emergencies, investments, or even retirement needs. Additionally, the death benefit guaranteed by whole life insurance ensures that your loved ones are protected, providing them with the necessary financial support in your absence.

One of the most compelling aspects of whole life insurance is its ability to be part of a broader financial planning strategy. Families can use the accumulated cash value to fund important life events, such as education costs or purchasing a home. The policy can also be passed down to heirs, providing them with a solid financial foundation for their future. This generational wealth building not only fosters financial independence but also teaches the value of financial responsibility and planning. By investing in whole life insurance, you are not only securing your financial future but also solidifying a lasting legacy for generations to come.